If you are into cryptocurrency or wish to earn cryptocurrency, you have heard about Bitcoin, Ethereum, and decentralized finance penetrating many industries.

For starters, DeFi aims to offer fintech products that secure distributed ledgers, eliminating bank fees and mediators. Also, this crypto subsector has grown tremendously in recent years, and 2023 is expected to be a critical year for the DeFi ecosystem.

So, in today's article, you will discover the state of DeFi in 2023, the emerging trends, the total value locked, and the leading projects. Let's take a deeper dive into decentralized finance.

What is DeFi?

To begin with, decentralized finance is a subsector of the cryptocurrency industry. DeFi uses emerging crypto and blockchain capabilities to offer traditional finance services while removing 3rd parties and centralized institutions, such as banks. Also, its infrastructure and regulations are constantly evolving, thus highly dependent on factors such as the use of blockchain technology, regulatory changes, and advancements in the ecosystem.

The decentralized finance sector's main objective is to bring the power of smart contracts alongside the DeFi components like stablecoins, software, and infrastructures that enable the development of applications.

Decentralized finance has multiple subtypes: exchange, lending, and insurance, on the same blockchain. We will tackle this subject as well, in just a bit.

Learn How Decentralized Finance Works

Usually, DeFi works on the same blockchain technology concept that crypto uses. As the blockchain gets distributed and secured, dApps handle and run the transactions confirmed by miners or validators.

Yet, the dApps creator personalizes their smart contracts to allow the functioning of decentralized exchanges, liquidity mining pools, decentralized borrowing, and much more. The novelty comes from the fact that DeFi allows crypto users to avoid centralized institutions even more than previously.

Centralized exchanges have always controlled who can access their platforms and what they can trade. But DEXes allow users to trade and exchange all kinds of tokens without much intervention.

Of course, these DeFi tokens do require large liquidity pools for users to be able to trade them effectively. And that opened up the gate for scammers. But with proper due diligence and continued improvement, the DeFi sector gets more promising.

Benefits and Disadvantages of DeFi

Pros:

- Reduced friction and transaction costs

- Increased transactions

- Transparency through blockchain-based records

- Greater stakeholder control

- Improved market access

- High level of privacy

Cons:

- DeFi is a complex concept - always stay up to date

- Fraud and scam risk increase due to lack of contro

- Many tokens lack liquidity

- High level of volatility

Learn About Decentralized Finance Use Cases

DeFi revolutionized the financial sector by allowing lending and borrowing, decentralized exchanges, stablecoins, prediction markets, and many more.

Open Finance

Open Finance or lending and borrowing refers to the ability of crypto holders to offer lending options to earn yearly yields to satisfy financial sector use cases while meeting the cryptocurrency community's needs.

Decentralized Exchange

DEX has existed since the introduction of the cryptocurrency concept, allowing you to access liquidity with the help of smart contracts. Also, it will enable you to swap crypto for crypto if they are on the identical blockchain.

DeFi Stablecoins

To combat the volatility issues afflicting cryptocurrencies and assist DeFi, stablecoins represent the practical solution that offers consistent prices. Due to their stability, they are dependable collateral assets.

DAOs

Decentralized Autonomous Organizations operate crypto and blockchain ecosystems to offer powerful and complex decentralized tools. These may refer to crypto-backed decentralized stablecoins, decentralized dApps infrastructures, smart contracts, decentralized lending, and more.

Prediction Markets

Prediction markets are digital products where users can predict future events' outcomes, and DeFi authorizes participation in these markets. Decentralized prediction markets have long been seen as a possibility via smart contracts. Furthermore, check the crypto by market cap for crypto market cap predictions, simulations, and statistics.

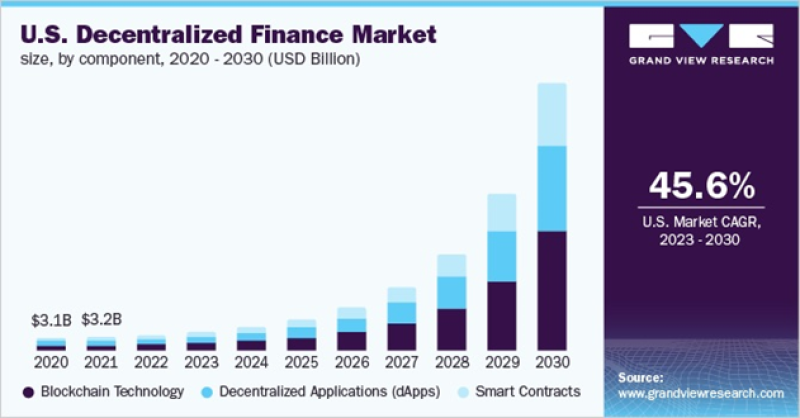

2023 - 2030 Decentralized Finance Market Size

In 2022, the global DeFi market was valued at USD 13.61 billion and was projected to reach a compound annual growth rate of 46.0% from 2023 to 2030. The DeFi market is expected to reach USD 16.33 billion in 2023.

Some key factors contributing to market growth include the increasing adoption of blockchain technology and digitized financial services.

What is The Total Value Locked in DeFi in 2023?

Total Value Locked (TVL) is a metric that counts the total worth of digital assets locked or staked in a decentralized finance platform or distributed application.

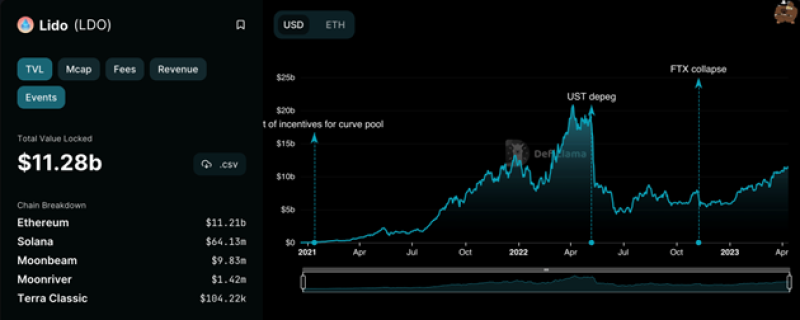

In April 2023, the TVL locked in DeFi is close to $51 billion and the dominant project is Lido. In fact, Lido dominance represents 22.27% of the total value locked in DeFi, almost $11.28 billion.

DeFi Trends That Matter in 2023

- Real-World Assets: Tokenizing real-world assets allows DeFi to tap into some of the largest financial markets.

- Greater stablecoin adoption: Despite bear market conditions, stablecoins remain among the top cryptocurrencies by market capitalization.

- Zero-Knowledge Proof: This digital verification method highlights that you can access information without necessarily divulging it. This dramatically impacts the crypto industry overall by improving sustainability and performance.

Top DeFi Leading Projects in 2023

Now, after you have learned more about the general aspects of DeFI, what the TVL is, and how it is calculated, it is time to understand better the decentralized finance ecosystem by analyzing the top leading projects in 2023.

Lido LDO

Developed in 2020, Lido is a native utility token for granting power rights in Lido DAO. Also used for adding or removing node operators, Lido allows you to become an ETH Proof-of-Work validator without staking 32 ETH or owning the infrastructure to host a node on the Ethereum blockchain.

The TVL of Lido is $11.28 billion, with a market cap of almost $2 billion, making it the most desired DeFi project of 2023.

Key features of Lido DAO:

- Managing fee structure

- Managing a set of liquid staking protocols

- Leveraging smart contracts

Also, a new upgrade is coming soon, impacting the Lido community significantly. The 'Ethereum Shanghai Upgrade' will permit validators to withdraw their staked ETH, improving Ethereum and making it more scalable. Gas fees are also expected to diminish, helping the layer-2 scaling solutions like Polygon, Arbitrum, and many more.

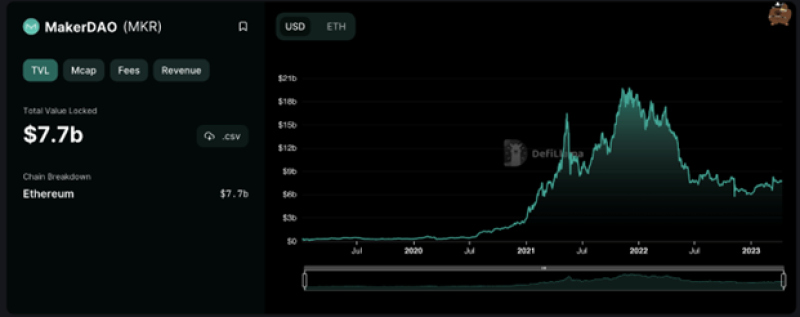

MakerDAO

Developed in 2014, MakerDAO is the largest DAO project on the Ethereum blockchain and the second largest DeFi, with a Total Value Locked at $7.7 billion.

MakerDAO offers decentralized borrowing, while the DAO is responsible for creating and managing the DAI stablecoin with a market cap value of $695.8 million.

However, Maker DAO is considered a 'complete solution' to further developing the community, being the first to launch a public SHO system that allows users to participate in early projects without holding $DAO.

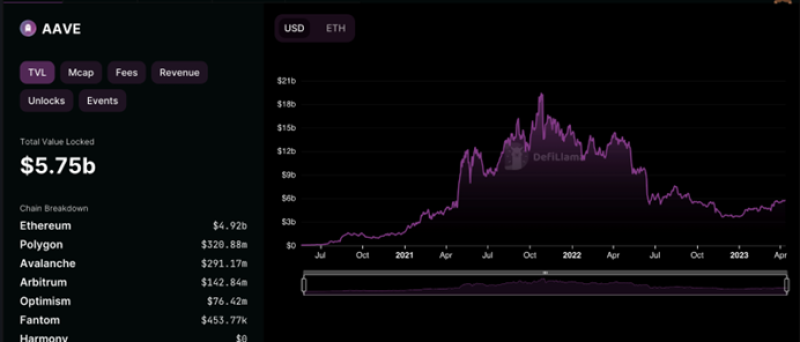

AAVE

Founded in 2017 and initially named ETHLend, AAVE has grown in popularity, allowing users to borrow or land money, thus earning crypto assets without intermediaries.

You must know that AAVE enables users to lend or borrow 17 different cryptocurrencies, including ETH, BAT, and MANA.

Also, AAVE has expanded to other chains such as Avalanche, Fantom, and Harmony and currently has pools for 30 Ethereum-based assets, such as Tether, Dai, and USD Coin.

The TVL of AAVE is currently at $ 5.75 billion, with a market cap of $ 1.08 billion.

Investing in DeFi Projects in 2023

As 2023 progresses and the cryptocurrency market shows signs of recovery, it's best to explore the opportunities DeFi offers. But it is more important to take the time to understand these opportunities well.

1. Liquidity Mining

Liquidity mining is one of the most sought opportunities that DeFi offers for earning passive returns. The concept is simple in appearance. Users can lock their assets within a DeFi protocol for a specific time and generate interest from fees on the token deposits.

However, there are variables such as price fluctuations and impermanent loss that can result in losing your funds.

2. Saving Accounts

You can either leave your crypto assets idle within your wallet or use them as savings in DeFi accounts, which offers higher yield, depending on the protocol.

Yet, keep in mind that an unbelievably high yield is usually a bad sign. Even in crypto, if a DeFi project offers too big of an interest it's highly likely that protocol won't be able to pay out everything it owns.

3. DeFi Borrowing & Lending

Another popular way of benefiting from DeFi is through borrowing against your assets or lending them out through a protocol.

Many traders profited in 2021 from this DeFi capability by borrowing against their BTC. They traded various assets to make a profit and liquidated their debt after their profits exceeded the interest.

This strategy is perfect for crypto holders who want to keep their original assets while trading around in a market that goes up continuously. However, 2023 is not that predictable regarding market direction, so assuming this strategy is foolproof can be risky.

Editorial staff

Editorial staff

Editorial staff

Editorial staff