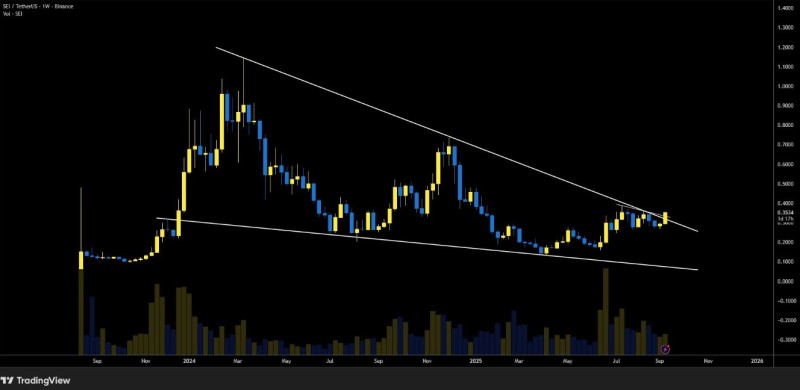

SEI has finally broken free from a descending wedge pattern that had constrained its price action for over a year. This technical breakout on the weekly chart represents a significant shift in market structure and could signal the start of a sustained bullish rally. With volume supporting the move and key resistance levels now in focus, traders are closely watching to see if SEI can maintain its momentum above critical breakout levels.

Weekly Breakout Confirmed

The breakout above the descending wedge's upper boundary marks a pivotal moment for SEI. The token has successfully pushed beyond the pattern that had kept it in a prolonged downtrend. With the price now trading above $0.35, the market sentiment has shifted from bearish to bullish, and the technical setup suggests this could be just the beginning of a larger move.

Analyst Sei Intern recently highlighted this significant technical development, noting the importance of this weekly chart breakout after such an extended consolidation period.

The descending wedge pattern, characterized by converging trend lines with declining highs and lows, is typically considered a bullish reversal pattern. When these patterns break to the upside with strong volume, they often lead to significant price rallies that can extend well beyond the immediate breakout zone.

Technical Structure and Key Levels

The current technical picture shows a clear break above the wedge resistance with several important levels coming into play. The $0.30 to $0.32 zone, which previously acted as resistance, has now flipped to become strong support. This is a crucial development as it provides a foundation for further upward movement.

Looking ahead, the immediate resistance zone sits between $0.40 and $0.42, which could provide the first meaningful test of the bullish momentum. If SEI can break through this level, extended targets come into view at $0.55 and potentially $0.70. The volume profile during the breakout has been encouraging, with bullish spikes indicating genuine trader participation rather than a false breakout.

Market Drivers and Momentum

Several factors appear to be contributing to SEI's bullish breakout. There's renewed optimism surrounding Layer 1 blockchain ecosystems as capital continues to rotate into alternative cryptocurrencies. The broader crypto market recovery has also provided a favorable backdrop for mid-cap assets like SEI to gain traction.

Additionally, ongoing development within the SEI ecosystem and strengthening fundamentals may be attracting investor attention. As the crypto market matures, projects with solid technical foundations and active development tend to outperform during bullish phases.

Future Price Potential

If the current momentum can be sustained, SEI appears well-positioned to target the $0.55 level in the near term. Longer-term projections suggest potential moves toward the $0.70 to $0.80 range, assuming the broader market remains supportive and the technical structure continues to hold.

However, traders should remain cautious of a potential retest of the breakout area around $0.32. Such retests are common following significant pattern breakouts and can provide additional confirmation of the new bullish trend. As long as SEI maintains its position above this critical support zone, the overall technical picture remains constructive for further upside movement.

Usman Salis

Usman Salis

Usman Salis

Usman Salis