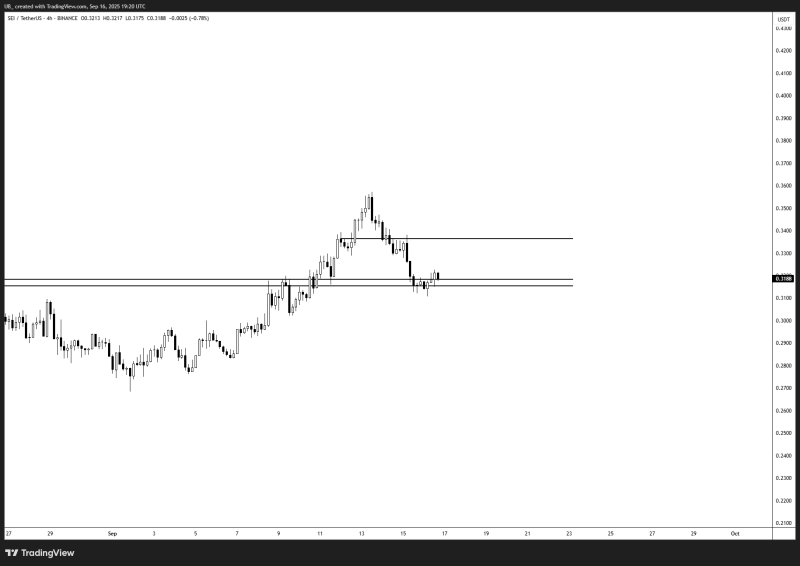

SEI is playing defense right now, and it's working. After recent pullbacks tested trader resolve, the token has managed to hold above two critical H4 support zones. This isn't just lucky - it shows real buying interest when prices dipped. The question everyone's asking: can SEI turn this defensive stand into an offensive push toward $0.335?

Key Levels to Watch:

- Current Support Zones: Two H4 levels acting as crucial floor

- Target Resistance: $0.335 (first major hurdle ahead)

- Volume: Increasing as broader altcoin recovery gains steam

The Bigger Picture

SEI's resilience comes at the right time. Altcoins are catching a bid across the board, and trading volumes are picking up. As UB pointed out, that $0.335 level is where things get interesting - break it, and we could see some real momentum. Fail to hold current supports though, and we're back to choppy waters.

The token's ability to maintain structure above these support zones puts it in decent position among mid-cap altcoins. It's not just surviving the recent volatility - it's positioning for what could be the next leg up.

Peter Smith

Peter Smith

Peter Smith

Peter Smith