Ripple's extensive XRP sales have puzzled many, with CTO David Schwartz shedding light on the reasons behind this significant strategy.

Ripple's Extensive XRP Sales Explained

Ripple has recently made waves in the crypto market with its substantial sales of XRP, leaving investors and analysts speculating about the motivations behind these moves. David Schwartz, Ripple’s Chief Technology Officer, has provided insight into the company’s strategic approach, shedding light on the rationale behind these significant transactions.

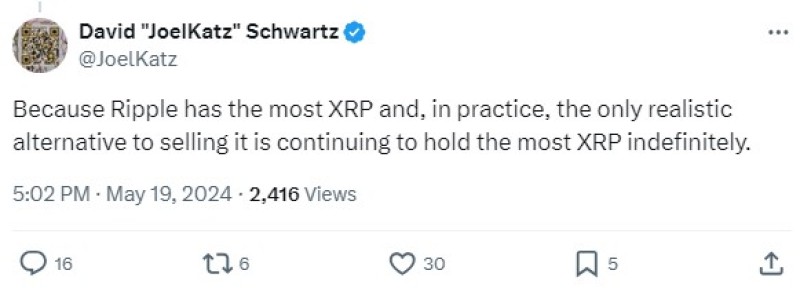

David Schwartz, Ripple’s CTO, has addressed the concerns surrounding the massive XRP sales by the company. He clarified that Ripple holds a large quantity of XRP and selling is the most practical option to manage their reserves. Schwartz stated, "The only practical alternative to selling is to continue holding them indefinitely." This strategy helps finance Ripple’s operations and development while also contributing to market stability. Additionally, selling XRP allows Ripple to support its ecosystem by funding various projects and initiatives.

Ripple's Controlled Release of XRP

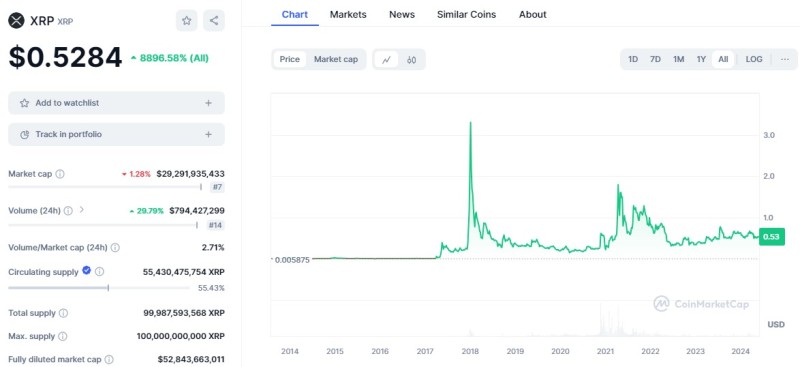

Ripple currently holds 4.8 billion XRP in its portfolio and another 40.1 billion in escrow, which are released gradually over a 42-month period. This controlled release strategy is designed to avoid a sharp devaluation of XRP, maintaining a balance in the market. By being transparent about its sales and release strategies, Ripple aims to build trust among investors and market participants. However, despite these measures, the ongoing sales raise questions about the potential long-term impact on XRP's value and its perceived utility.

Ripple’s continuous sales of XRP have significant implications for the crypto market. Regularly selling large amounts of XRP can exert constant pressure on its price, potentially hindering the asset’s ability to stabilize or grow. However, Ripple's controlled management of these sales helps mitigate sudden fluctuations and avoids rapid devaluation. This approach aims to maintain a stable market environment, though it still leaves some investors wary.

Financing Ripple's Operations Through XRP Sales

The decision to sell a portion of its XRP reserves is also a means for Ripple to finance its operations and support ecosystem development. This practice, however, raises questions among investors about Ripple’s long-term vision and the sustainability of relying on XRP sales for funding. Some investors view the continuous sales as a sign of Ripple’s dependence on these funds rather than other revenue streams, creating an atmosphere of uncertainty for XRP holders.

Constant XRP sales by Ripple have led to concerns about the long-term value and utility of the cryptocurrency. Investors must closely monitor Ripple's actions and their potential impacts on their investments. The strategy of selling XRP to fund operations and initiatives, while maintaining market stability, presents a complex scenario that requires careful observation and analysis by market participants.

In conclusion, while Ripple’s strategy of selling XRP is aimed at financing its operations and fostering ecosystem growth, it also brings about challenges and uncertainties regarding the long-term impact on the cryptocurrency’s value. As Ripple continues to navigate this approach, the crypto community remains attentive to the evolving dynamics and their implications for XRP's future.

Peter Smith

Peter Smith

Peter Smith

Peter Smith