Dogecoin and other meme tokens maintain strong trade volumes and resilience despite market fluctuations, according to Kaiko's latest report.

Dogecoin Shows Resilience Amid Market Corrections

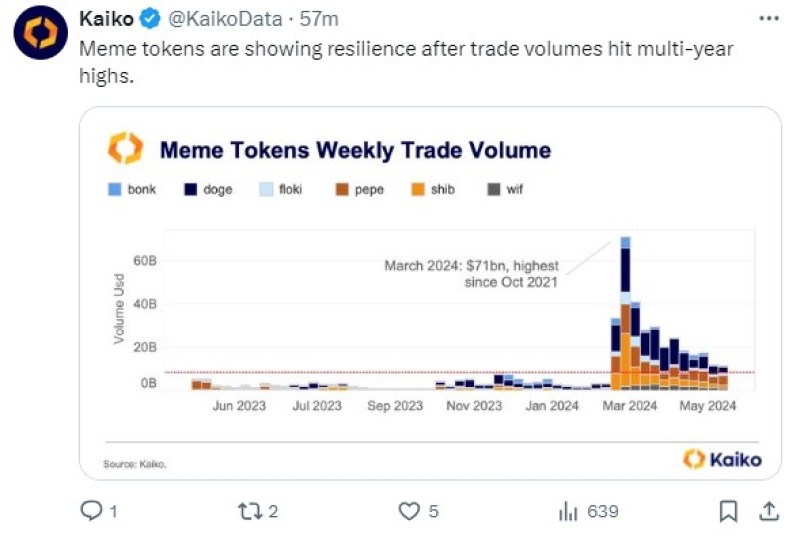

Despite a cooling off in the broader crypto market and a slowdown in Bitcoin's momentum, Dogecoin and other meme tokens have demonstrated notable resilience. Kaiko reports that these assets, often dismissed for their lack of utility, have maintained higher liquidity levels than seen earlier this year, indicating their lasting presence in the market.

Kaiko's data reveals that meme tokens have weathered the recent market corrections better than expected, with year-to-date (YTD) returns ranging from 80% to an impressive 1800%. Weekly trade volumes for these tokens have surged by more than 200% YTD, reaching approximately $11 billion. This performance is largely attributed to the tokens' accessibility and their ability to adapt to changing market trends, drawing substantial community interest.

Analyst Insights on Dogecoin and Meme Token Trends

"Meme tokens have shown an unexpected resilience in the face of market corrections, maintaining strong trade volumes and performance," noted a Kaiko analyst. The analyst emphasized that the popularity of these tokens is driven by their ease of access and the robust community engagement they foster.

Meme tokens, including Dogecoin, tend to exhibit higher leverage compared to most altcoins, making them more susceptible to speculative trading behavior. Despite this, the correlation between meme tokens and other retail-driven speculative assets, such as meme stocks, remains relatively weak and highly volatile. For instance, the 60-day rolling correlation between Dogecoin (DOGE) and the video game retailer GameStop (NYSE:GME) has stayed mostly below 0.3 over the past year.

Recent Surge in Meme Stocks and Its Impact on Dogecoin

In a surprising development, meme stocks like GameStop (GME) and AMC Entertainment (NYSE:AMC) experienced a significant surge on May 13-14, which in turn influenced the correlation between Dogecoin and GameStop. "Meme stocks saw a notable uptick last week, which also affected the correlation between Dogecoin and GameStop," Kaiko observed. "This spike in correlation highlights the interconnected nature of retail-driven speculative assets."

As the market continues to evolve, the resilience of Dogecoin and other meme tokens underscores their potential to remain significant players in the crypto space. Despite the inherent volatility and speculative nature of these assets, their sustained performance and community support suggest a lasting presence.

Conclusion

Dogecoin's ability to maintain robust trade volumes and perform well amidst market corrections is a testament to its resilience and the strong community backing it enjoys. As meme tokens continue to attract interest and adapt to market dynamics, their role in the broader crypto ecosystem appears to endure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah