Cryptocurrency exchange Coinbase is launching a new Bitcoin (BTC) yield fund on May 1, aiming to provide a 4-8% net annual return in BTC for institutional investors looking to generate yield on their Bitcoin holdings.

Bitcoin (BTC) Yield Fund Details and Launch Timeline

Coinbase Asset Management announced the upcoming launch of its Bitcoin Yield Fund via Twitter. Set to debut on May 1, the fund implements a conservative investment strategy targeting 4-8% net returns in Bitcoin per year over a market cycle. A key feature of the fund is that investors will both subscribe and redeem their investments directly in Bitcoin, rather than converting to fiat currency.

In their official blog post explaining the rationale behind this new offering, Coinbase cited growing institutional demand for Bitcoin yield opportunities. The company has positioned this product as a response to increasing interest from institutional clients seeking ways to generate returns on their Bitcoin holdings.

Bitcoin (BTC) Yield Generation Challenges Addressed

Unlike traditional financial assets or proof-of-stake cryptocurrencies such as Ethereum and Solana, Bitcoin does not inherently generate yield through staking or other built-in mechanisms. This limitation has led to the emergence of various Bitcoin yield funds, but many of these solutions require institutional investors to accept considerable investment and operational risks.

Coinbase's new fund aims to mitigate these challenges by reducing both expected investment and operational risks. Rather than moving assets out of secure storage, Coinbase Asset Management will utilize third-party custody integrations for trading activities, which the company believes significantly reduces counterparty risk for investors.

Institutional Bitcoin (BTC) Demand Shows Strength in Recent Data

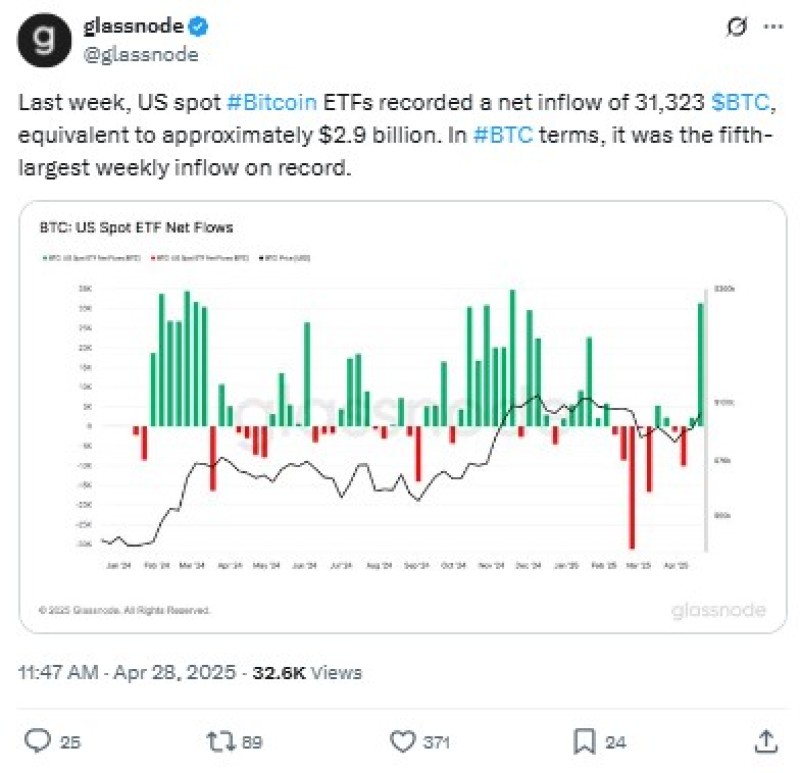

The launch comes amid strong institutional interest in Bitcoin. According to data from Glassnode, U.S. spot Bitcoin ETFs received net inflows of 31,323 BTC (approximately $2.9 billion) last week. This represents the fifth-largest weekly inflow on record when measured in Bitcoin terms.

When measured in dollar value, last week's inflow ranks as the third-largest on record, behind only November 18, 2024 ($3.33 billion) and December 2, 2024 ($2.91 billion). These substantial inflows demonstrate continued institutional engagement with Bitcoin, even as the cryptocurrency trades at relatively high price levels.

Ethereum (ETH) Also Seeing Renewed Institutional Interest

The positive sentiment isn't limited to Bitcoin. Ethereum, the second-largest cryptocurrency by market capitalization, has also shown signs of renewed institutional interest. According to Glassnode data, Ethereum ETFs recently recorded their first positive net inflow following eight consecutive weeks of outflows.

While the Ethereum inflow was modest at approximately 40,000 ETH, it potentially signals a shift in institutional sentiment regarding ETH exposure. This comes at a time when the broader cryptocurrency market continues to mature and gain acceptance among traditional financial institutions.

The Coinbase Bitcoin Yield Fund represents another step in the evolution of institutional cryptocurrency products, allowing large investors to potentially earn passive income on their Bitcoin holdings while maintaining the asset's exposure to market price movements.

Peter Smith

Peter Smith

Peter Smith

Peter Smith