Cardano (ADA) could push toward $0.66-$0.68 this month, though traders should stay cautious as weekly charts remain bearish and network activity keeps declining.

Cardano has been quietly climbing since early July, and things are starting to look interesting. The token bounced from $0.536 and has already gained 17%, sitting at $0.626 right now. But before you get too excited, there's more to this story.

Sure, ADA looks bullish on the daily charts, but zoom out to the weekly view and it's a different picture entirely. The weekly structure is still bearish, showing lower highs and lower lows since December. That's not exactly what you want to see if you're betting on a major comeback.

ADA Price Analysis Shows Mixed Technical Signals

Here's where it gets tricky. The daily chart actually looks pretty decent – ADA has been making higher lows and higher highs over the past two weeks. It broke past $0.62 (the 50% retracement level) and the RSI crossed above 50, which usually means momentum is shifting from bearish to bullish.

The On-Balance Volume is creeping higher too, suggesting there's steady demand behind this move. That's encouraging and might fuel further gains in the short term.

But here's the reality check: the weekly chart is still painting a bearish picture. The key support at $0.535 (78.6% Fibonacci level) is holding for now, but if it breaks, we could see another 30%-40% drop. That's a pretty big risk to consider.

Cardano (ADA) Faces Tough Resistance at $0.68

Looking ahead, ADA has a clear target – the $0.68 level. This isn't just any resistance; it's the 78.6% retracement level sitting right in a fair value gap from June. Think of it as a supply zone where sellers have historically shown up.

If Bitcoin stays bullish, ADA could reach $0.66-$0.68 without too much trouble. But breaking above $0.68? That's going to be the real test. The combination of Fibonacci resistance and that fair value gap creates a pretty solid ceiling that won't be easy to crack.

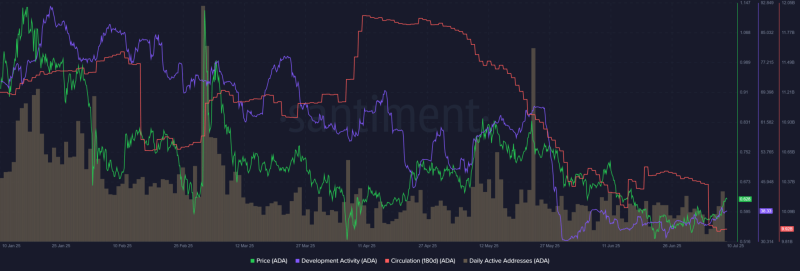

Network Activity Raises Red Flags for ADA

Here's where things get concerning. While price action might look okay, what's happening on-chain tells a different story. Development activity has been sliding since February – not great for a blockchain that used to pride itself on high developer engagement.

The 180-day circulation shows reduced on-chain activity, and daily active addresses have been pretty meh since March. Basically, fewer people are actually using the network, which makes any price rally feel a bit hollow.

Without real demand and organic growth, even if ADA hits that $0.66-$0.68 target, it's going to struggle to stay there. The fundamentals just aren't backing up the price action right now.

So what's the play? Traders can probably expect a move to $0.66-$0.68, especially if Bitcoin keeps doing well. But don't get too greedy – breaking past $0.68 is going to be tough, and the smart money seems to be waiting on the sidelines until ADA can prove it has real staying power beyond that supply zone.

Peter Smith

Peter Smith

Peter Smith

Peter Smith