Bitcoin's pullback from its record high looks like typical profit-taking rather than a real trend change. Long-term holders and miners are still confident, keeping the bullish outlook alive.

Bitcoin just hit an incredible $123,000 all-time high before quickly pulling back as traders cashed in on their gains. While the correction might look scary on the surface, the underlying story is actually pretty encouraging for anyone betting on Bitcoin's long-term success.

Crypto analyst Nic Puckrin from Coin Bureau put it perfectly: "Bitcoin smashed past the $120,000 mark over the weekend, breaking above a seven-year trendline that has acted as a strong resistance level since 2018. This is an incredibly bullish signal, especially given the environment this is happening in."

BTC Price Shows Classic Profit-Taking Behavior

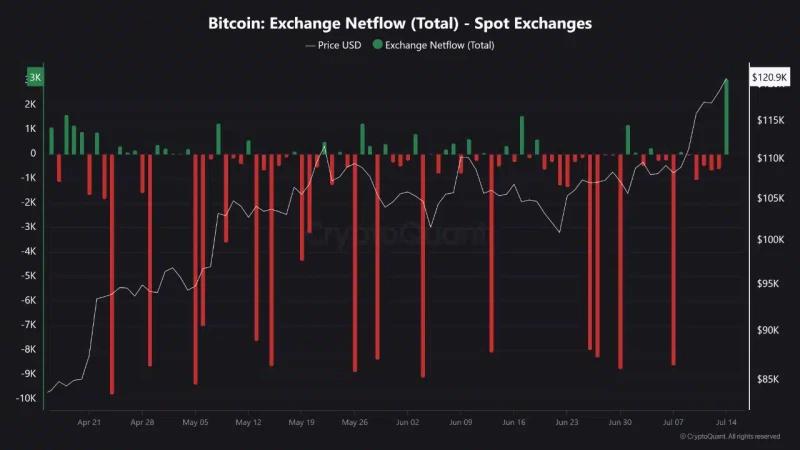

When Bitcoin hit $123K, the data tells a clear story. CryptoQuant tracked a massive spike in coins flowing into exchanges – over 3,000 BTC – which was the biggest selling wave since April. This broke weeks of the opposite trend where more Bitcoin was leaving exchanges than entering.

Short-term holders and some whales clearly saw $123K as a good time to take profits. But here's the key part: long-term holders didn't join the selling spree. That's usually a sign the bull market isn't over yet.

The technical picture backs this up too. Bitcoin dropped to $116,800 from its peak, and the daily RSI cooled from overbought levels to around 64.8. The MACD is still positive, though it's flattening out a bit. The big red candle on July 15th shows selling pressure kicked in hard at the top.

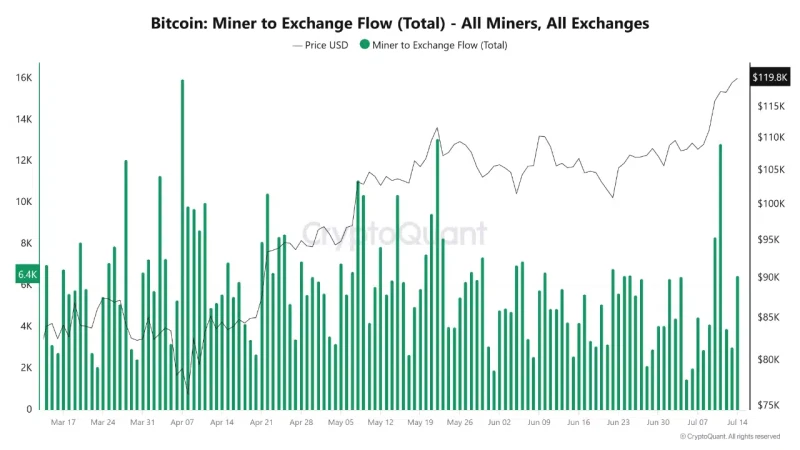

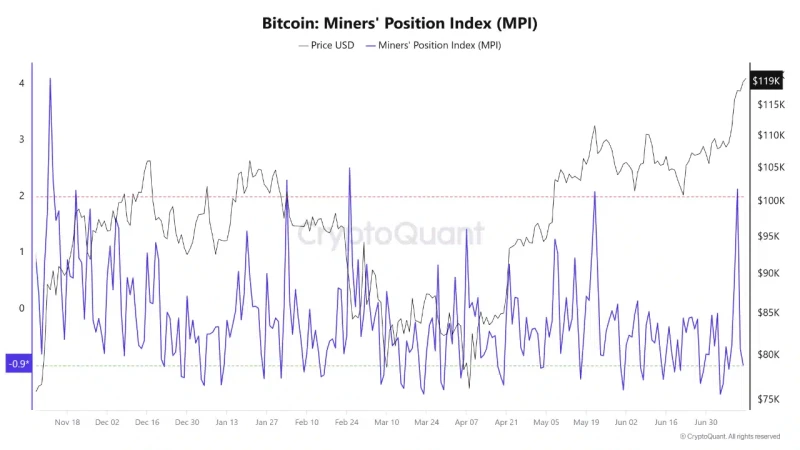

Bitcoin (BTC) Miners Aren't Selling

While short-term traders rushed to sell, miners took a completely different approach. Data shows they've actually reduced the amount of Bitcoin they're sending to exchanges. The Miners' Position Index dropped back to neutral territory, meaning they're not under pressure to sell right now.

This is huge because miners usually have bills to pay and need to sell Bitcoin regularly. When they hold back, it often means they think prices are going higher. Given how good miners have been at timing their exits historically, this could be a strong signal that the rally has more room to run.

Puckrin pointed out something interesting about this correction: "The Bitcoin long/short ratio is currently overbalanced in favor of the longs, while 24-hour liquidations are close to $1 billion, so a short-term reversal in the price is almost guaranteed, with liquidations looming at around $118,000."

BTC Price Rally Looks Different This Time

What makes this Bitcoin rally stand out is who's driving it. Puckrin noted that "unlike previous all-time highs, future funding rates are still at normal levels, meaning the risk of cascading liquidations is low." This suggests the current price levels aren't built on dangerous leverage that could collapse quickly.

Even more interesting: "retail buyers are nowhere to be seen yet. This rally is still driven by institutional capital, while the typical signs of retail involvement – soaring search traffic and crypto app rankings – are absent."

This is actually bullish for Bitcoin's future. Past cycles show that when retail investors finally jump in, that's when prices really explode. If institutions are already pushing Bitcoin to $123K without retail help, imagine what happens when regular people start buying again.

The short-term outlook might include some bumps – that overbalanced long/short ratio and potential liquidations around $118K suggest Bitcoin might need to cool off before pushing higher. But breaking that seven-year resistance trendline is a massive technical achievement that validates the bullish case.

Bottom line: this looks like a healthy correction in an ongoing bull market rather than the end of the party. With institutions still buying and retail yet to arrive, Bitcoin's story might just be getting started.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah