Amidst the fervent bullish sentiment in the metals sector, gold prices have soared, surpassing previous targets. However, signs of potential correction loom large.

XAU Momentum: Riding High, but Risks Lurk

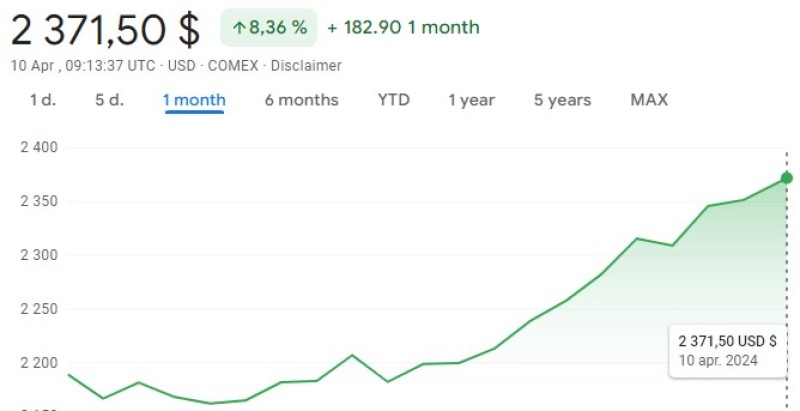

Gold's meteoric rise has been nothing short of remarkable, with prices exceeding expectations by $30, hitting a target set at the beginning of March. Despite this bullish fervor, caution flags are waving as momentum indicators on both weekly and daily timeframes are showing signs of being overstretched. Additionally, XAU finds itself far above its historical 200-week moving average, a potential signal of overheating.

Last week, analysts pointed to momentum and price movements as indicators that a correction might be on the horizon. The charts vividly illustrate this sentiment, hinting at potential downside targets. While these targets remain above key breakout points, the possibility of a significant correction looms large. Even the closest trendline, though offering some support, may only serve as a minor buffer against potential downturns.

As evidence mounts suggesting that XAU and silver may be nearing a temporary top, prudent investors are considering defensive maneuvers. With the market showing signs of overheating and potential correction, strategists advise preparing for a possible downturn. While the bullish sentiment has been dominant, it's crucial to remain disciplined and vigilant in the face of evolving market dynamics.

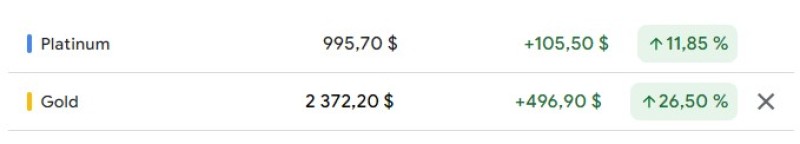

Platinum: A Forgotten Contender?

While gold grabs headlines with its surging prices, platinum, often overshadowed, remains an intriguing asset. Despite its relative obscurity in recent discussions, platinum's potential merits attention. As gold faces a potential correction, could platinum emerge as a viable alternative or complementary investment?

The Role of Market Discipline

Calling the top of a bullish run is no easy feat, particularly amid a market characterized by fervent momentum. However, maintaining discipline and vigilance is paramount. As investors navigate the choppy waters of the metals market, staying attuned to indicators and remaining prepared for potential shifts is key to safeguarding investments and capitalizing on emerging opportunities.

In summary, while XAU continues its impressive ascent, signs of potential correction are emerging. Investors are advised to exercise caution and prepare for possible market shifts, while also considering overlooked alternatives such as platinum. As the metals market evolves, adaptability and strategic planning will be critical for success.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah