Turns out you don't need a market meltdown to send gold prices soaring. According to JPMorgan, even a tiny 0.5% shift from U.S. assets into gold (XAU) could push prices to a whopping $6,000 by 2029.

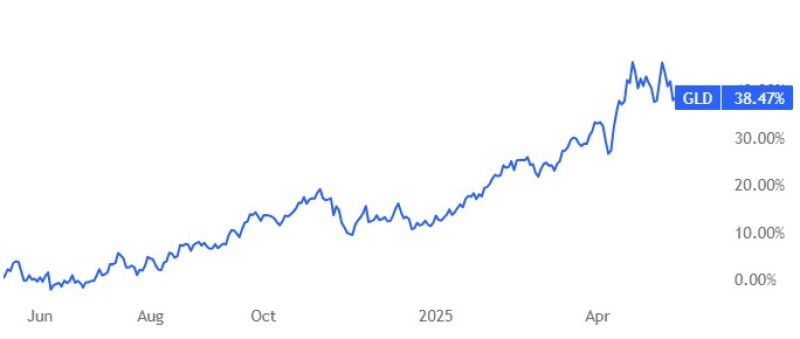

Gold (XAU) is already having a stellar year, up nearly 28% as trade tensions heat up and inflation fears linger. But JPMorgan's latest analysis suggests we might just be seeing the beginning of something much bigger for the precious metal.

Why Gold (XAU) Could Skyrocket Without Much Effort

Here's the fascinating bit: JPMorgan's number-crunchers found that if global investors moved just half a percent of their U.S. holdings into gold—about $274 billion—it could trigger an 18% annual gain. Keep that going for a few years, and you're looking at gold prices jumping from today's $3,500 to around $6,000 by 2029.

What makes this possible? Unlike most markets, gold's supply barely budges year to year. That means even small upticks in demand can send prices through the roof. As JPMorgan puts it, "A marginal allocation tweak can translate into a dramatic price surge."

The Perfect Storm Brewing for Gold (XAU)

It's not just investor whims driving this potential rally. Washington's "burden sharing" trade moves are making dollar holdings less attractive for international investors. When the dollar loses its shine, gold typically gleams brighter.

Let's face it—gold has always been the go-to safe haven when things get dicey. With trade tensions simmering and geopolitical uncertainty seeming like the new normal, more investors are eyeing gold as insurance against whatever comes next.

What an $6,000 Gold (XAU) Price Would Mean for Your Portfolio

An 80% jump in gold prices wouldn't just mean good news for gold bugs—it would likely shake up traditional investment strategies across the board. We could see serious money flowing out of stocks and bonds and into precious metals as performance-chasing investors pile in.

Financial advisors aren't telling clients to go all-in on gold just yet, but they're definitely suggesting keeping an eye on Fed minutes and breaking news that could spark the rally JPMorgan is forecasting.

Gold (XAU) Already Showing Its Muscle

Let's not overlook the fact that gold has already surged nearly 28% this year. That's not pocket change. The precious metal has been benefiting from a perfect cocktail of sticky inflation, escalating trade tensions, and lingering doubts about currency stability after years of easy money policies.

While the Fed has been fighting inflation with higher rates, many investors are sticking with gold anyway. It's like having an insurance policy against economic surprises—and lately, surprises have been the only consistent thing in markets.

What to Watch as Gold (XAU) Climbs Higher

If you're thinking about jumping on the gold train based on JPMorgan's bullish outlook, keep your eyes peeled for a few key signals. First, watch what the Fed does next. Hints of lower rates typically give gold a nice boost since it makes non-yielding assets more attractive.

Also worth tracking: how U.S. trade policies evolve, especially with major trading partners. Any moves that make dollar holdings less appealing could accelerate the gold rush JPMorgan is predicting.

And don't forget those unpredictable geopolitical flare-ups. While nobody can forecast the next crisis, having some gold exposure might help you sleep better if markets hit turbulence.

What's really eye-opening about JPMorgan's analysis is how little it would take to drive such massive price changes. In today's hyper-connected global markets, even small shifts in investor sentiment can snowball into major price movements for assets like gold that have relatively fixed supply.

Whether gold actually hits that $6,000 target is anyone's guess, but JPMorgan's research offers a compelling roadmap for how we might get there. And given gold's performance so far this year, it might be worth paying attention to those glittering prospects.

Peter Smith

Peter Smith

Peter Smith

Peter Smith