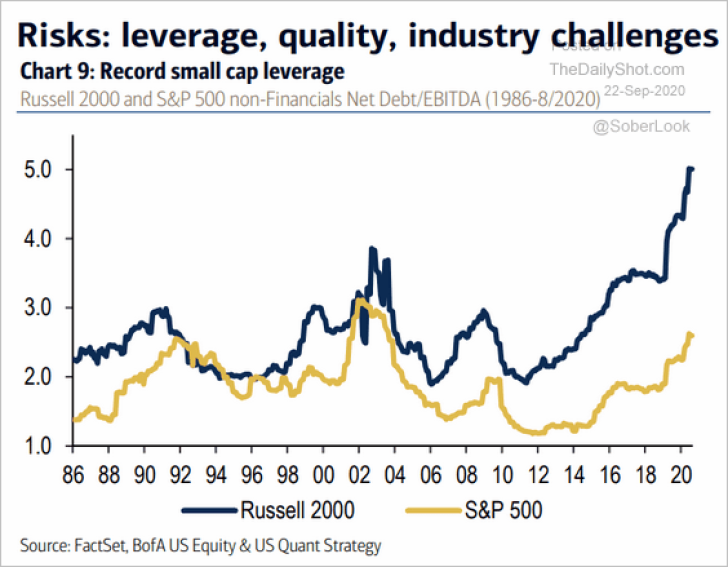

Currently, small-business stocks that make up the Russell 2000 trades with large leverage that significantly exceeds the S&P 500's leverage, according to the Bank of America.

The reasoning behind this anomaly is pretty straightforward: lower caps are more likely to issue equities and more likely to go bankrupt in a worst-case scenario to transfer profits to shareholders or to invest in growth.

Usman Salis

Usman Salis

Usman Salis

Usman Salis