Is the European Central Bank using the Federal Reserve approach?

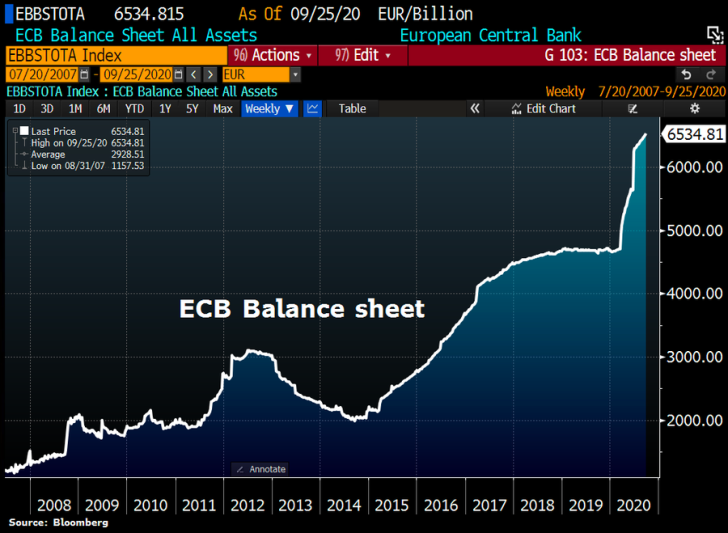

The balance sheet of the European Central Bank ( ECB) continues to grow, with the Central Bank's pandemic-emergency acquisition program record-breaking funds. Scarce inflation-hedges like gold are bragging the extraordinary balance sheet growth.

#ECB ramps up balance sheet expansion. Total assets rose by €32.4bn, most since July, to hit another ATH at €6,534.8bn. ECB balance sheet now equal to 64% of Eurozone GDP vs BoJ's 136.5%, Fed's 36.4% and BoE's 35.5% Holger Zschaepitz @Schuldensuehner via Twitter

Who Benefits from Inflating the Balance?

The 'Cantillon' impact notes that banks and institutional investors who usually put the money into securities, financial properties, are the key beneficiaries of the unequal growth of money supply. The expansion of the ECB's balance sheet is thus also beneficial to inventories.

In an effort to raise credit and to avert the economic recession sparked by this pandemic of the coronavirus, the European Central Bank has eased the rules on the eurozone banks and has put aside up as much as $73 billion of cash.

Usman Salis

Usman Salis

Usman Salis

Usman Salis