The global artificial intelligence race is reshaping Taiwan's manufacturing landscape in unprecedented ways. As hyperscale data centers rush to upgrade their infrastructure with cutting-edge AI capabilities, Taiwan's original equipment manufacturers have emerged as the critical backbone of this technological transformation, posting extraordinary financial results that reflect the broader AI revolution sweeping across industries.

Taiwan's AI Server Surge in Context

The numbers tell a compelling story of Taiwan's dominance in AI hardware manufacturing. The island's top six manufacturers posted a staggering NT$1.11 trillion (US$36.6 billion) in revenue for August 2025 alone, representing a remarkable 24.8% increase compared to the same period last year. This surge is primarily attributed to the widespread adoption of Nvidia's Blackwell GPU architecture, which has become the gold standard for next-generation AI computing.

According to trader Dan Nystedt, the "Big 6" companies - Foxconn, Quanta, Wistron, Inventec, Wiwynn, and Gigabyte - are experiencing unprecedented order volumes as tech giants Microsoft, Google, Amazon, and Meta aggressively expand their AI infrastructure capabilities.

These hyperscalers are not merely upgrading existing systems but fundamentally reimagining their data center architectures to support increasingly sophisticated AI workloads.

Chart Analysis: 2024 vs 2025 Monthly Sales Performance

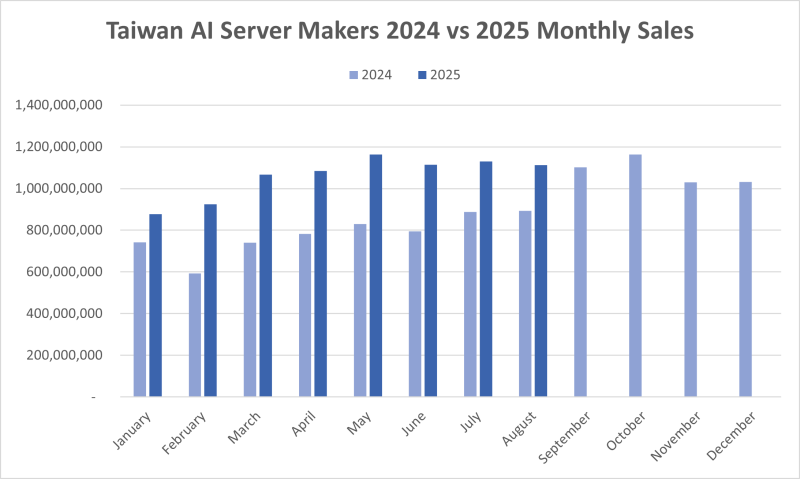

The comparative analysis between 2024 and 2025 monthly sales reveals several critical trends that underscore Taiwan's growing importance in the global AI ecosystem. Every single month in 2025 has significantly outperformed its 2024 counterpart, with August representing the peak at approximately NT$1.11 trillion. The early months of 2025, particularly February through May, demonstrated consistent momentum above 2024 levels, indicating sustained demand rather than temporary market fluctuations.

Interestingly, despite this explosive growth, traditional seasonal patterns remain intact. The data shows familiar mid-year peaks and softer performance in early months, suggesting that even revolutionary technology adoption follows established corporate IT spending cycles and budget planning processes.

Why Taiwan Leads the AI Server Market

Taiwan's dominance stems from three fundamental competitive advantages that competitors struggle to replicate. The rapid adoption of Nvidia's Blackwell architecture has created massive demand for high-density server configurations that require sophisticated manufacturing capabilities and precision assembly processes. Taiwan's original equipment manufacturers have built integrated supply chains that seamlessly combine design expertise, large-scale assembly operations, and global distribution networks at unmatched efficiency levels.

The current AI arms race between nations and corporations worldwide has intensified competitive pressures to secure advanced computing resources, driving orders to unprecedented levels. This geopolitical dimension adds another layer of urgency to procurement decisions, benefiting Taiwan's established relationships with major technology companies.

Toward a New AI Spending Era

We are entering a fundamentally different era of technology spending. Nvidia's ambitious target of over $100 billion in annual AI chip revenue within two years suggests Taiwan's server manufacturers could collectively approach US$400 billion in annual sales if current demand persists.

This growth represents Taiwan's evolution into an indispensable AI infrastructure hub. As artificial intelligence applications become more sophisticated, the island's manufacturing capabilities will become increasingly critical to global technological advancement.

Peter Smith

Peter Smith

Peter Smith

Peter Smith