The cryptocurrency market is witnessing a notable transformation in XRP (Ripple) investor base, as on-chain metrics indicate a substantial migration of coins into the hands of short-term traders. This shift carries important implications for both price volatility and market dynamics in the coming weeks.

Short-Term Holders Drive Market Activity

Fresh on-chain data reveals a sharp rise in short-term XRP holders, with supply controlled by this group surging 38% over the past month. According to analyst STEPH IS CRYPTO, XRP's on-chain dynamics are shifting as more coins move into the hands of traders focused on quick profits rather than long-term accumulation.

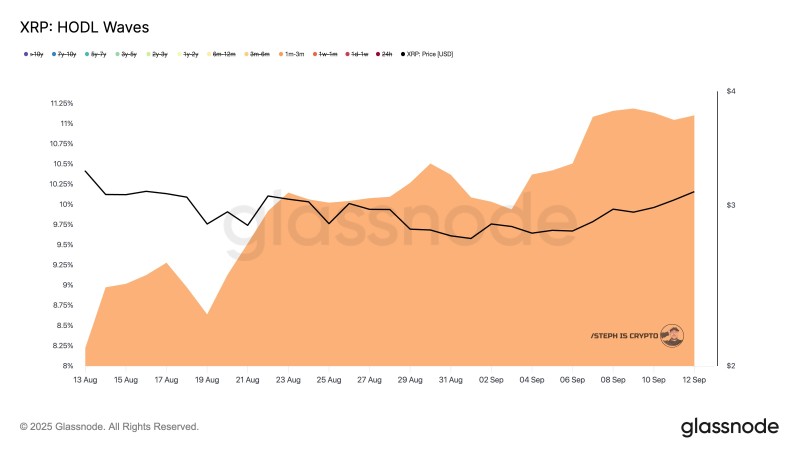

The latest Glassnode "HODL Waves" data shows a notable increase in the proportion of XRP supply held for less than one month. This surge underscores renewed trading activity and speculative demand, with market participants positioning themselves to capture short-term price movements rather than viewing XRP as a long-term investment vehicle.

Chart Analysis and Key Insights

The chart tracks XRP's price against the distribution of supply held across different time horizons, revealing several important patterns. The orange zone representing coins held for one week to one month expanded steadily through late August into September, confirming the significant supply growth among short-term holders. During this same period, XRP traded in a relatively narrow range near $3.00 to $3.20, indicating that much of this inflow occurred during sideways price action rather than dramatic rallies.

This buildup of short-term holders often precedes larger price swings, as this group tends to react quickly to market momentum shifts. The concentration creates a setup where volatility could increase substantially in either direction, depending on how these traders respond to future price movements.

Market Implications

The increase in short-term holders presents a double-edged scenario for XRP. On the positive side, it reflects heightened interest in the token, possibly linked to recent favorable regulatory developments, rising trading volumes, and speculation around Ripple's expanding institutional partnerships. This renewed attention brings additional liquidity and trading activity to the market.

However, a high concentration of short-term investors also makes XRP more vulnerable to sudden sell-offs, as these holders typically have lower conviction and are quicker to take profits when momentum shifts. This dynamic could amplify both upward and downward price movements in the near term.

Future Price Scenarios

If XRP breaks convincingly above the $3.30–$3.40 resistance zone, the surge in speculative demand could fuel a push toward higher price levels as short-term holders ride the momentum. Conversely, if upward momentum fades or negative catalysts emerge, the heavy short-term positioning could lead to a rapid pullback as traders exit their positions quickly.

For long-term investors, this data provides an important reminder that while short-term waves bring energy and liquidity to the market, it is ultimately the long-term holders who provide price stability and support during volatile periods. The current shift toward short-term ownership suggests that XRP may experience increased price swings in the coming weeks, requiring investors to adjust their risk management accordingly.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah