After an incredible run that's seen Alphabet shares climb relentlessly for two months straight, Google stock is now staring down a critical resistance level at $242. This isn't just another technical hurdle - it's the kind of make-or-break moment that could determine whether this rally has more gas in the tank or if it's time for a breather. With the stock having already delivered massive gains to investors, the question everyone's asking is simple: can Google punch through this ceiling, or is this where the music stops?

The Rally That Won't Quit

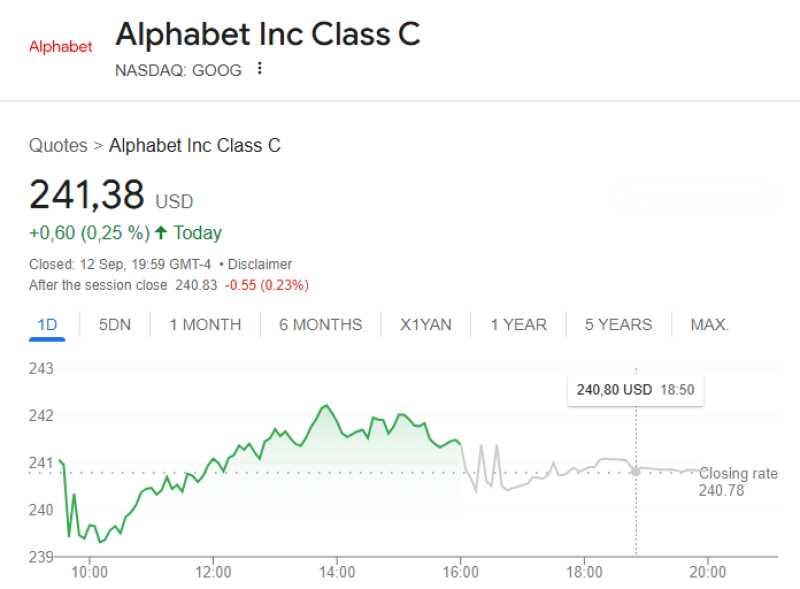

Google stock has been absolutely crushing it lately. After breaking past $200, it's rocketed all the way to $242.33 where it's now hitting some serious resistance. We're talking about nearly two straight months of gains through August and September, driven by everything from AI hype to recovering ad spending and cloud growth. As ThomasJamesInvesting pointed out, Google's momentum has been "crazy" these past weeks, making it one of the best performers among the tech giants.

Key Levels Every Trader Should Know

- Support at $198.13 - This was the old breakout level that's now acting like a safety net

- Resistance around $242-243 - Multiple daily candles are getting rejected here

- Next target at $250-255 - If it breaks above $242, this is where we're headed

- Pullback zone at low $230s - Where the stock might cool off if resistance holds

The technical picture is pretty clear: Google's at a make-or-break moment. Push through $242 and we could see a run to $250. Get rejected here and expect some cooling off in the $230s before the next attempt.

What's Fueling This Monster Run

Google's firing on all cylinders right now. Their AI push with Gemini is getting integrated everywhere - Search, Ads, Cloud - and investors are eating it up. The digital advertising world is finally stabilizing after a rough patch, especially in retail and travel where companies are opening their wallets again. And while Google Cloud still trails Microsoft and Amazon, it's posting solid double-digit growth that's helping diversify their revenue beyond just ads.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah