NVIDIA has been on a tear lately, and the momentum shows little sign of letting up. The chip giant's stock has been steadily climbing, catching the attention of both retail and institutional investors who are betting on the company's continued dominance in AI and data center markets.

NVIDIA (NVDA) Price Extends Its Uptrend

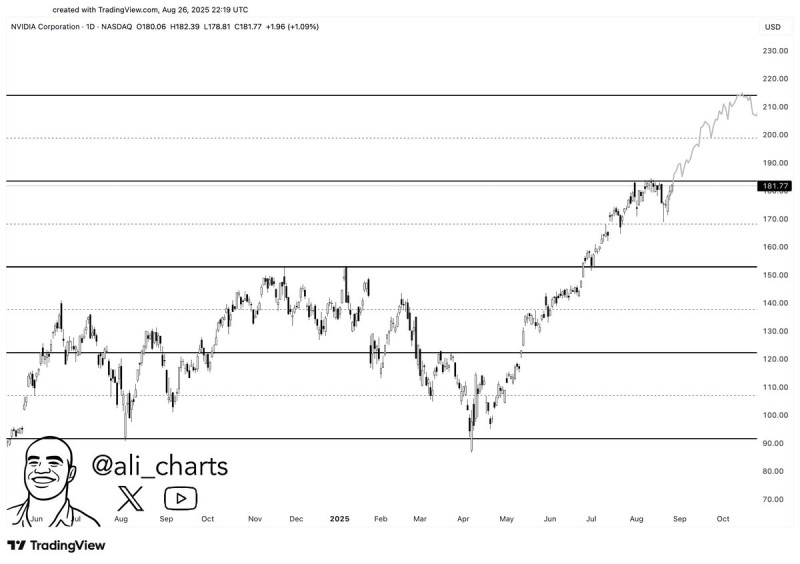

The stock is currently trading around $181.77, and it's looking pretty solid at these levels. What's got traders excited is how cleanly NVDA has been moving higher – no messy pullbacks or concerning weakness, just steady, consistent gains.

Market analyst @ali_charts recently pointed out that NVIDIA could be setting up for another significant move higher, potentially targeting the $220 area. His analysis shows clear support and resistance zones that suggest the stock is comfortably riding within a bullish channel.

NVIDIA (NVDA) Price Technical Setup

From a technical standpoint, things look encouraging. Since the early 2025 lows, NVDA has been making higher highs and higher lows – exactly what you want to see in a healthy uptrend. The stock has solid support around $170, while the next hurdle sits somewhere between $190-200.

If buyers can push through that $190 level with conviction, we're likely looking at a move toward $210-220, where some traders might start taking profits. But until we see any real weakness, the trend remains your friend here.

The near-term picture for NVDA looks pretty good. A clean break above $200 would probably bring in more buying interest and could fast-track the stock to that $220 target over the next few weeks.

Even if we see some selling pressure around these higher levels, it would likely just be a normal pause in what's been a strong upward move. With NVIDIA's AI and data center business continuing to draw institutional money, the bigger picture still looks positive.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah