In today's interconnected global economy, a single policy decision can instantly reshape entire markets. NVIDIA Corporation, the world's leading AI chip manufacturer, just experienced this reality firsthand when Chinese authorities announced restrictions that could fundamentally alter the company's international business model. As geopolitical tensions between major powers increasingly spill over into technology markets, investors and traders are discovering that even the most dominant companies aren't immune to sudden regulatory shifts. This latest development with NVIDIA serves as a perfect case study of how quickly market dynamics can change in our current environment.

Market Shock Hits NVIDIA

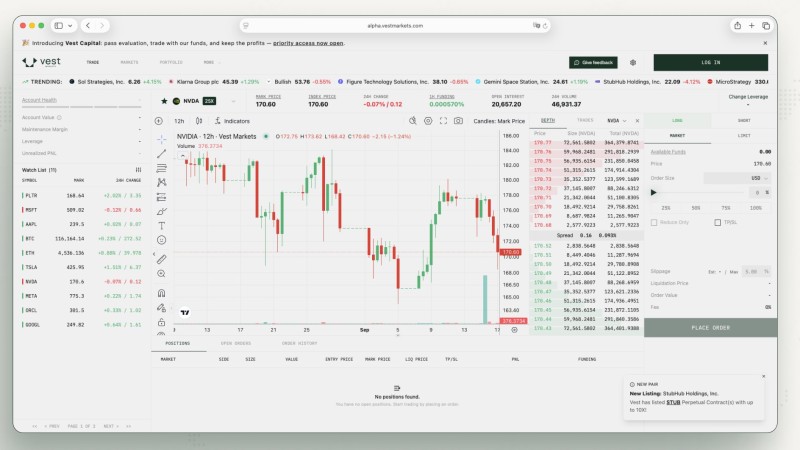

According to Vest, the semiconductor giant just faced a major market catalyst that sent ripples through the entire tech sector. When news broke that China would restrict its domestic companies from buying NVIDIA's advanced AI chips, traders immediately took notice. This development comes at a particularly sensitive time, as the company was already dealing with existing U.S. export controls that have pressured international AI chip demand.

The restriction potentially cuts off access to one of NVIDIA's most important international markets right when global demand for AI infrastructure is reaching new heights. For a company that has built its recent success on the AI boom, losing access to Chinese buyers represents more than just a revenue hit—it's a fundamental shift in the global tech landscape.

Technical Picture Shows Heavy Selling

Looking at the 12-hour chart, the selling pressure becomes crystal clear. The stock couldn't hold above the $176-$178 resistance zone, showing that bears have taken control. With immediate support sitting around $168 and the next major level at $163, there's plenty of room for more downside if sentiment doesn't improve quickly.

What's particularly telling is the volume spike to 376.37k shares, confirming that this isn't just casual selling—institutional players are making serious moves. The market seems to be positioning for either continued downside or setting up for a potential short squeeze if any positive news emerges.

Why Traders Should Pay Attention

This situation perfectly illustrates how geopolitics can instantly override fundamentals in today's market. NVIDIA remains the undisputed leader in AI hardware, with demand for its products growing exponentially across industries. However, when trade policies shift overnight, even the strongest companies can see their stock prices whipsawed.

The volatility creates opportunities for both bulls and bears, especially with leveraged trading platforms now offering significant exposure to these moves. Smart traders are watching for either a breakdown below key support levels or signs that the selling has been overdone.

Usman Salis

Usman Salis

Usman Salis

Usman Salis