While most economists are penciling in sluggish growth for the rest of 2025, the Atlanta Fed's real-time economic tracker is painting a rosier picture. But here's the catch: this optimistic forecast might not last long.

Atlanta Fed's Growth Tracker Defies Pessimistic Consensus

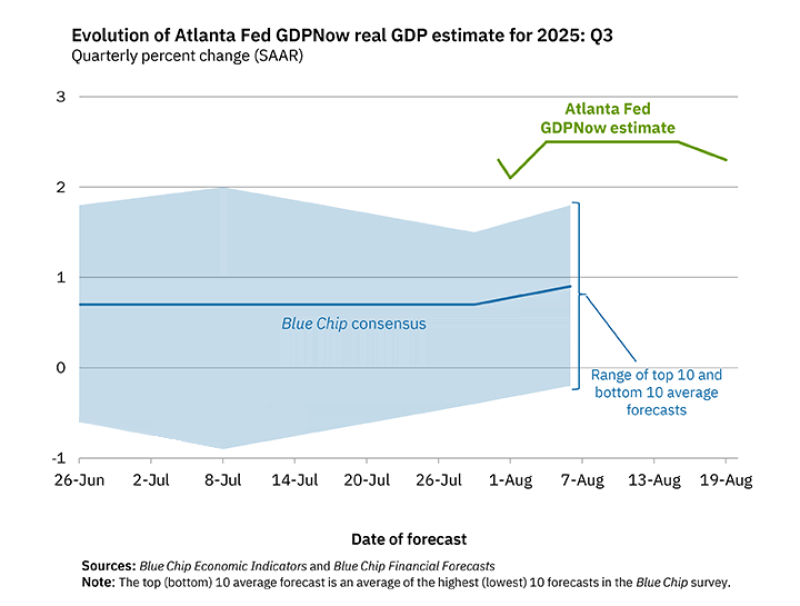

The Atlanta Federal Reserve's GDP model is sticking to its guns with a 2.3% annualized growth forecast for the third quarter of 2025. That's more than double what most economists are expecting, creating one of the widest gaps between real-time data and expert opinion we've seen in months.

This isn't just academic number-crunching. The GDP model processes fresh economic data as it rolls in – everything from retail sales to factory output – giving it a reputation for catching economic shifts before traditional forecasters do. But that same sensitivity makes it prone to dramatic swings that often smooth out over time.

When the Experts Can't Agree

The disconnect runs deeper than just GDP versus consensus. Among professional forecasters, predictions are all over the map. The most optimistic economists see growth near 2%, while the pessimists are calling for something closer to flat. It's the kind of spread that usually signals major uncertainty about where the economy is actually headed.

What's driving this confusion? Recent data has been sending mixed signals. Consumer spending shows pockets of strength alongside concerning weakness. Manufacturing data bounces between expansion and contraction. Trade numbers shift monthly. In this environment, even sophisticated models struggle to pin down the true trajectory.

The Revision Reality Check

Here's what seasoned economic watchers know: GDP estimates rarely stay put. As one market observer recently noted, "given the trend of the data as of late this will likely be revised lower in the weeks ahead." Translation: enjoy the 2.3% while it lasts.

The pattern is familiar. Early in a quarter, GDP often runs hot or cold compared to where growth actually lands. As more comprehensive data arrives – particularly the monthly employment reports and comprehensive trade figures – the estimate typically gravitates toward something closer to consensus.

What This Means for Your Money

If growth does moderate toward that 1% consensus range while inflation remains sticky, the Federal Reserve faces an uncomfortable squeeze. They can't easily cut rates to juice growth if prices are still climbing, but they also can't keep tightening if the economy is genuinely slowing.

For investors, this uncertainty translates into continued volatility. Markets hate not knowing whether we're heading for a gentle economic cooldown or something more abrupt. The 2.3% forecast offers hope for a "goldilocks" scenario, but the brewing downward revisions suggest we might not be so lucky.

Peter Smith

Peter Smith

Peter Smith

Peter Smith