The crypto markets just witnessed something significant. Litecoin exploded higher by 5.5% following Grayscale's surprise ETF filing, but the real story is happening behind the scenes. Whale wallets are accumulating at levels we haven't seen in months, with on-chain data revealing massive inflows that suggest smart money is positioning for something big. This isn't just another price pump - it's institutional-grade buying that could reshape LTC's trajectory.

The Smart Money is Moving

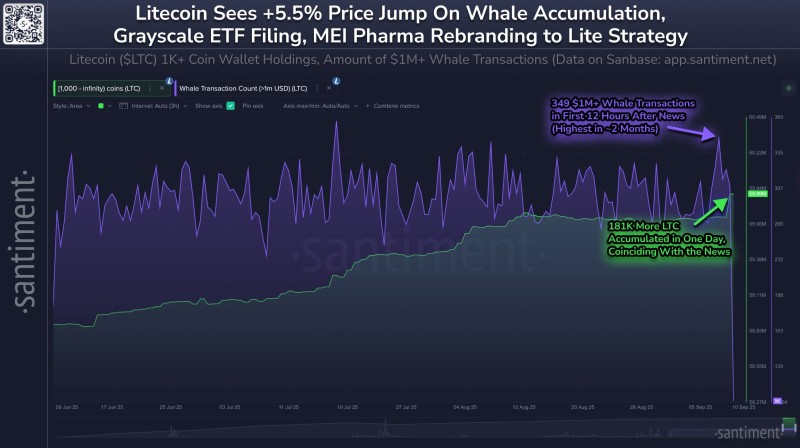

Litecoin just got a major vote of confidence from the people who matter most - the whales. After Grayscale dropped their ETF filing bombshell, big wallets didn't waste any time. Data from trader PRIME shows that addresses holding at least 1,000 LTC added a massive 181,000 coins in just 24 hours. That's not retail FOMO - that's calculated accumulation by players who see something coming.

The timing tells the whole story. Within 12 hours of the ETF news breaking, Santiment recorded over 349 transactions worth more than $1 million each. That's the highest spike in whale activity we've seen in nearly two months. Meanwhile, LTC's price jumped 5.5%, moving in perfect sync with this buying pressure.

Three factors are driving this accumulation wave:

- ETF momentum: Grayscale's filing puts Litecoin in the institutional spotlight alongside Bitcoin and Ethereum

- Digital silver narrative: LTC historically outperforms during crypto bull runs as Bitcoin's cheaper alternative

- Technical setup: The combination of whale inflows and price action suggests a strong foundation for further upside

The ETF angle is particularly interesting. While approval isn't guaranteed, the mere filing signals that traditional finance is taking Litecoin seriously as an investable asset. Smart money often positions ahead of these regulatory catalysts, and that's exactly what we're seeing now.

Price Targets and Risk Management

From a technical perspective, bulls need to clear the $70-$75 resistance zone first. If whale accumulation continues and broader crypto sentiment remains positive, LTC could realistically target $80-$85 in the near term. The good news is that all this buying near $60 has created a solid support floor, giving traders a clear risk management level.

The bigger picture here isn't just about short-term price moves. Whale accumulation suggests institutional players are positioning for something larger. If Grayscale's ETF gets approved, Litecoin could see the kind of sustained demand that drives multi-month rallies. For now, the smart money is already making its bet.

Peter Smith

Peter Smith

Peter Smith

Peter Smith