All those warnings about tariffs triggering another inflation nightmare? The latest data says maybe not. The Philadelphia Federal Reserve just dropped some numbers that tell a completely different story about where price pressures are actually heading.

What the Philly Fed Numbers Actually Show

Analyst Andreas Steno Larsen recently pointed out something interesting - what he calls "survey-inflation" might already be rolling over. His take? That scary "mega-spike" everyone's been talking about could turn out to be a total bust.

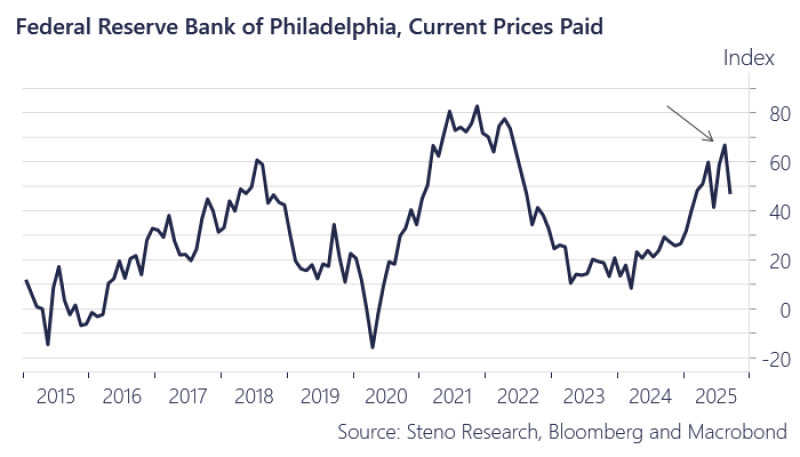

The Current Prices Paid Index tracks what manufacturers shell out for raw materials and supplies. It's been a pretty reliable crystal ball for inflation trends:

- 2021-2022 surge: The index shot past 80 during the supply chain chaos - those were real cost pressures hitting hard

- 2023 collapse: Everything cooled off as demand settled and commodity prices stabilized

- 2024-2025 rebound: Tariff headlines pushed it back toward 60, but the latest reading shows momentum clearly fading

- Current situation: The index is sitting well below previous peaks and looks like it's topping out

The chart tells the whole story - input cost inflation appears to be losing steam again, just like it did before.

Remember all that panic about tariffs crushing the economy with massive price increases? Reality check time. Companies did see higher costs, sure, but nothing close to the disaster scenarios floating around. The whole "tariff spike" story was probably overblown from the start.

What This Means for Markets

If survey inflation really has peaked, everything changes. The Fed might not need to keep hammering away with rate hikes if cost pressures are actually cooling down. Bond yields could stabilize without constant inflation fears driving them higher. And growth stocks, especially in tech and housing, might finally catch a break from all the inflation paranoia.

The Philadelphia Fed's data suggests we're not heading for some inflation apocalypse after all. As Andreas put it, that "mega-spike" everyone feared might never show up. Sometimes the scariest headlines make for the weakest actual trends.

Usman Salis

Usman Salis

Usman Salis

Usman Salis