America's economy in 2025 tells a tale of two realities. On one side, artificial intelligence investments are driving unprecedented growth in corporate spending. On the other, everyday Americans are struggling with rising costs and weakening purchasing power. This economic split is creating what economists are calling "stagflation-lite" - a troubling scenario where big tech companies flourish while middle-class families face mounting financial pressure.

AI Spending Outpaces Consumer Demand

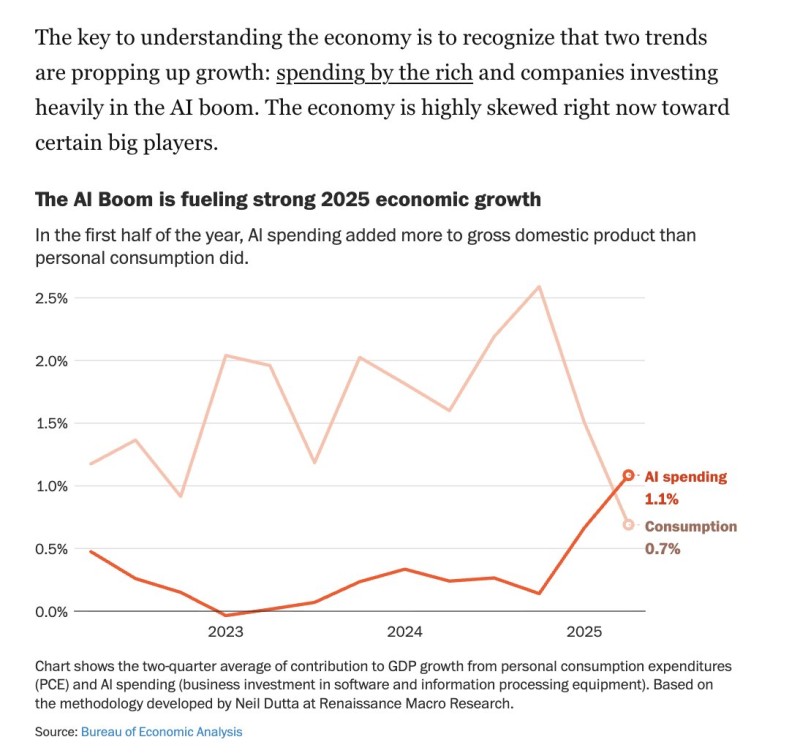

The numbers paint a clear picture of this economic divide. As trader Heather Long recently highlighted, AI-related investments are now contributing more to GDP growth than traditional household spending. During the first half of 2025, AI spending boosted GDP by 1.1%, while personal consumption added only 0.7%.

This represents a fundamental shift in how America's economy is growing, with corporate technology investments taking the lead over consumer purchases for the first time in decades.

The Underlying Economic Shift

Bureau of Economic Analysis data shows this isn't just a temporary blip. Since 2023, consumer spending growth has steadily weakened while AI-driven corporate investments have surged. This pattern suggests America's economic recovery is being powered by boardroom decisions rather than Main Street spending. The implications for working families are concerning: unemployment is creeping up, prices continue rising, and wage growth remains sluggish. This combination creates what some economists call "stagflation-lite" - not the severe stagflation of the 1970s, but a milder version where economic growth exists alongside persistent inflation and stagnant living standards.

Research from Renaissance Macro Research reveals just how concentrated current growth has become. Neil Dutta's analysis shows the economy is increasingly dependent on select sectors, particularly technology and AI. If consumer demand continues to lag while only wealthy investors and tech companies drive growth, income inequality will widen and economic volatility could increase dramatically.

What Lies Ahead

The AI boom may be propping up GDP numbers, but it's also exposing dangerous economic fragility. Without a revival in consumer spending, America risks entering a prolonged period where economic gains benefit only the wealthy while most households face stagnation. Policymakers face the challenging task of managing inflation, supporting labor markets, and ensuring that economic growth reaches all Americans - not just Silicon Valley and Wall Street.

Peter Smith

Peter Smith

Peter Smith

Peter Smith