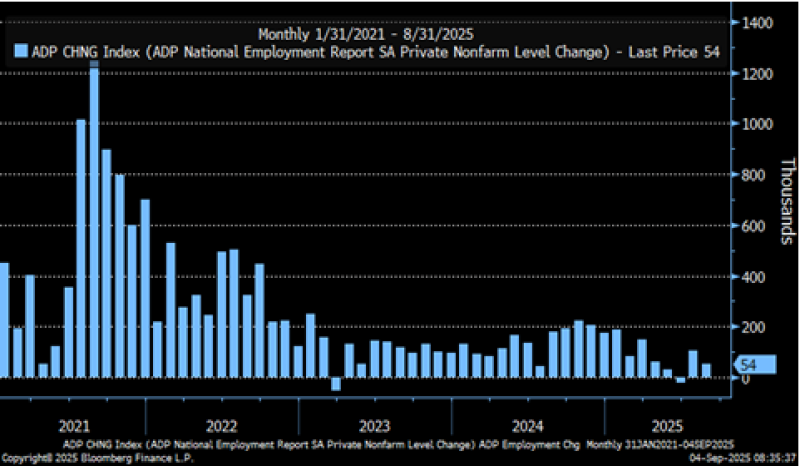

The U.S. economy just delivered another curveball. August's ADP employment report showed private companies added only 54,000 jobs—a surprisingly weak number that's got economists scratching their heads. What makes this particularly tricky? Inflation is still running hot, putting the Fed in an uncomfortable spot where they're damned if they do, damned if they don't.

Labor Market Weakness Meets Inflation Pressure

Market strategist Kathy Jones hit the nail on the head: we're looking at a classic policy trap. Jobs are drying up fast, but prices aren't cooling down to the Fed's 2% sweet spot. Friday's official payroll numbers are expected to come in around 75,000—another sign that economic momentum is clearly fading.

This toxic combo of weak job growth and stubborn inflation is flashing warning signs of stagflation. It's the nightmare scenario where policymakers have to pick their poison: cut rates to save jobs or keep them high to tame prices.

Inflation Still Won't Back Down

Even as hiring slows to a crawl, inflation keeps eating into people's wallets:

- Consumer prices are still running above 3%—way higher than the Fed wants

- Housing, healthcare, and energy costs remain frustratingly "sticky"

- Wages are cooling but still pushing up demand and prices

The big question now: will weak job data finally trump inflation worries in the Fed's playbook?

What This Means for Your Money

Rate cuts are looking more likely by the day. If Friday's jobs report confirms the slowdown, the Fed might have to act fast to prevent a deeper employment crisis. But here's the catch—cutting rates while inflation runs hot could trash the dollar and send prices soaring again.

Expect some wild market moves: stocks might rally on rate cut hopes, bond yields could tumble, and safe havens like gold and Bitcoin might get a boost as investors hedge against both inflation and policy chaos.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah