Something weird is happening in the markets right now. While bond yields are falling and suggesting the economy might need help, commodities are absolutely ripping higher. This strange split is putting central banks in a really tough spot - do they cut rates to help with all that debt, or do they let inflation run wild? It's not exactly the kind of choice you want to make.

Yields Fall, Commodities Break Higher

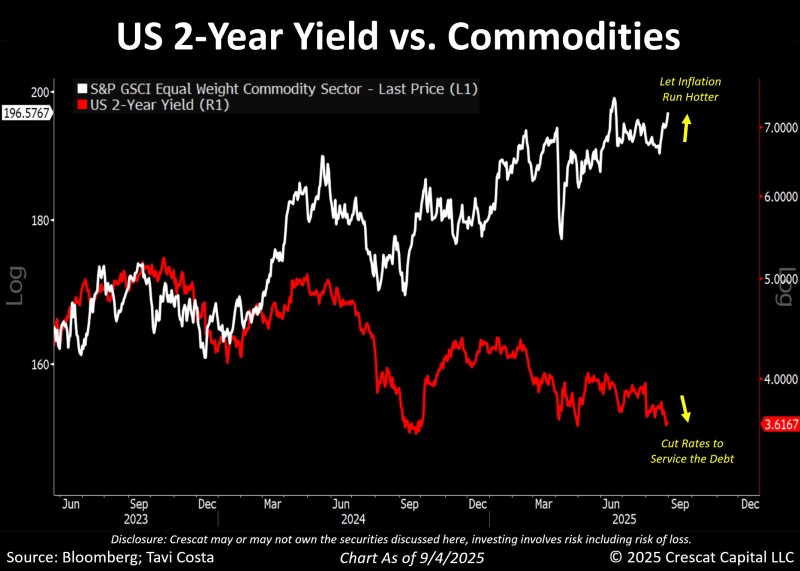

Analyst @TaviCosta posted a chart that shows just how dramatic this split has become. The US 2-year yield has crashed to around 3.6% - that's multi-year low territory. Meanwhile, commodities (tracked by the S&P GSCI Equal Weight Index) have rocketed up to 196.5, getting close to all-time highs.

Costa put it perfectly: "Cut rates to service the debt, or let inflation run hotter." That's basically the impossible choice facing policymakers right now.

Here's what this divergence is telling us:

Bond weakness: Markets are betting on rate cuts or slower growth ahead.

Commodity strength: Raw materials are screaming that inflation isn't going anywhere.

Policy trap: Central banks are stuck between helping with debt problems and fighting price pressures.

Inflation's Release Valve

When yields drop, money usually flows into real stuff - oil, metals, farm products. These commodities become the escape route for all that inflation pressure. The problem? It makes traditional monetary policy way less effective, leaving central bankers with fewer tricks up their sleeves.

This isn't just a temporary market quirk - it's showing us some serious structural problems in the global economy. For investors, expect more volatility ahead. Commodities are back in the spotlight as an inflation hedge, while bonds are reflecting just how fragile things have gotten.

Peter Smith

Peter Smith

Peter Smith

Peter Smith