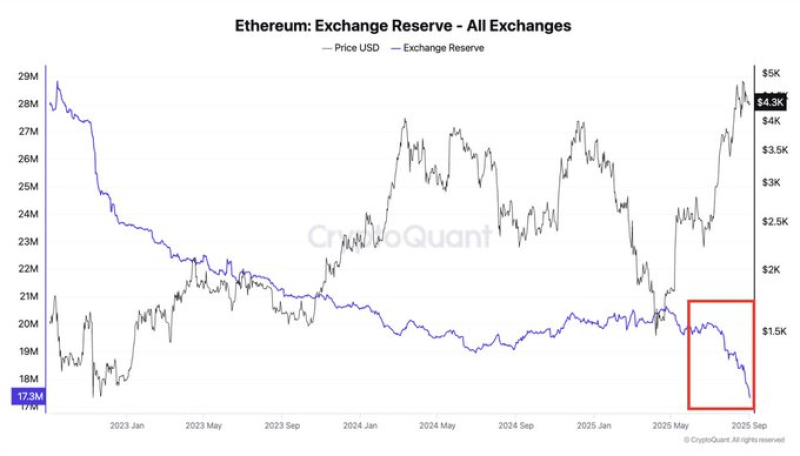

Something interesting is happening with Ethereum that could have major implications for its price. The amount of ETH sitting on exchanges - the coins that are easiest to buy and sell - has been steadily shrinking and just hit a multi-year low. This kind of supply tightening often sets the stage for significant price moves, and smart money is starting to take notice.

Ethereum's Exchange Reserves Hit Multi-Year Lows

Ethereum is hitting a major milestone as exchange reserves keep dropping. The latest data shows only 17.3 million ETH left on exchanges - one of the lowest levels we've seen in years.

Crypto analyst @Blackmen_10 pointed out that this trend signals much tighter liquidity in the market. When there's less ETH available for trading, it usually creates favorable conditions for anyone holding onto their coins for the long haul.

Why ETH Reserves Matter for Price Action

Think of exchange reserves as the ETH that's ready to trade at any moment. When these numbers drop, it means coins are getting locked up in staking, moved to private wallets, or grabbed by institutions - basically taken off the market.

Here's what's driving this shift:

- More ETH getting staked and locked away

- ETF demand bringing in institutional buyers

- Big players moving coins into long-term storage

- Fee burns from EIP-1559 reducing total supply

It's like a popular concert where tickets keep getting scarcer - the fewer available, the more valuable each one becomes.

We're looking at a classic supply and demand situation:

- Supply shrinking: Only 17.3M ETH left on exchanges

- Demand growing: ETFs, institutions, and staking driving interest

- Result: Building pressure for higher prices

Just like any limited product that everyone wants, Ethereum's growing scarcity could push prices up as more people chase fewer available coins.

Conclusion: Ethereum Positioned for Growth

Ethereum is showing one of the strongest supply signals in the crypto market right now. With reserves falling and demand staying strong, ETH looks set up for potential gains over the medium to long term.

We might see some short-term ups and downs, but the underlying trend is pointing toward higher prices ahead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah