Ethereum (ETH) faces a critical juncture as the leading altcoin tests key resistance levels, with futures traders positioning for potential upside momentum. ETH currently trades within a well-defined horizontal channel, setting up what could be a decisive breakout moment.

ETH Price Action: Trapped Between Support and Resistance Since August

Leading altcoin Ethereum has been locked in a horizontal channel since August 12, creating a fascinating technical setup that has traders on edge. The world's second-largest cryptocurrency by market cap has been oscillating between clearly defined boundaries, with resistance firmly established at $4,664 and solid support holding at $4,211. This sideways price action has created a pressure cooker environment where traders are anxiously awaiting a decisive breakout that could set the tone for ETH's next major move.

Currently trading at $4,385, Ethereum finds itself caught in the middle of this range, but recent data suggests that the scales might be tipping in favor of the bulls. The prolonged consolidation has created an interesting dynamic where both sides of the market are building their positions, setting the stage for what could be an explosive move in either direction.

ETH Bulls Targeting $4,500 Sweet Spot

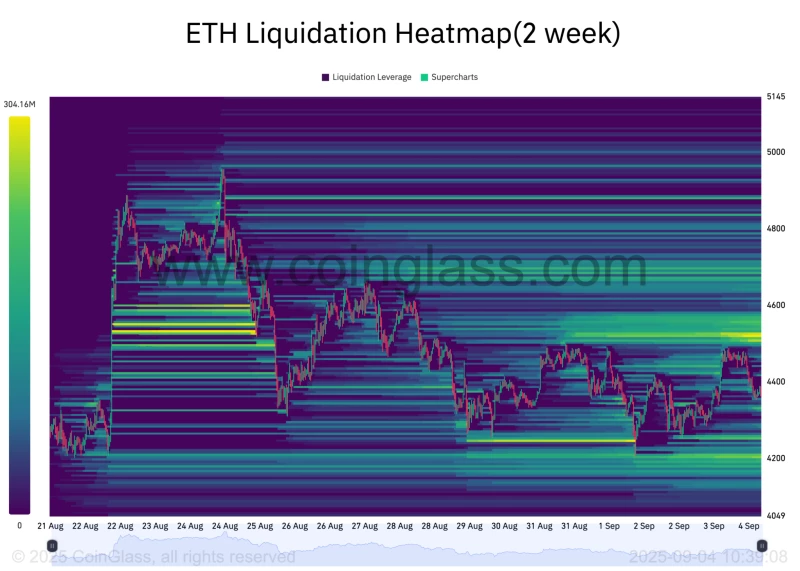

Here's where it gets interesting. Coinglass data shows a massive liquidity cluster building right at $4,520 – that's like a magnet pulling ETH's price upward. Think of it this way: when the market sees all those leveraged positions sitting there, it wants to grab that liquidity.

These liquidation zones don't lie. They're basically roadmaps showing where the market wants to go next, and right now, all signs point to $4,500.

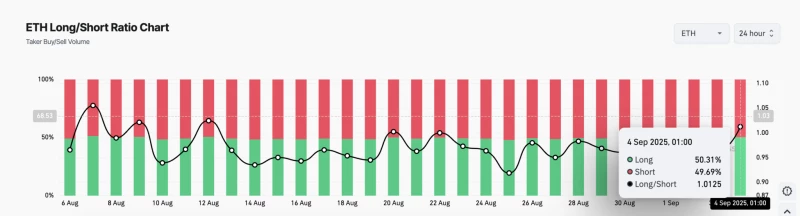

What's even better for bulls? ETH's long/short ratio just hit 1.01, meaning more traders are betting on upside than downside. It's not a massive tilt, but in crypto, even small shifts in sentiment can trigger big moves.

ETH's Make-or-Break Moment: $4,957 or $3,626?

If bulls win this battle, ETH could smash through the $4,664 ceiling and head straight for its all-time high of $4,957. That's a tasty 13% gain from here – not too shabby for a few weeks of trading.

But here's the thing about crypto: it cuts both ways. If demand dries up and ETH drops below $4,211 support, we could see it tumble all the way to $3,626. That's a brutal 17% drop that would leave a lot of bulls licking their wounds.

The setup's pretty clear – Ethereum's about to pick a direction, and when it does, it's going to move fast. With that juicy liquidity sitting above current levels and futures traders leaning bullish, the smart money seems to be betting on upside. But in this game, always expect the unexpected.

Usman Salis

Usman Salis

Usman Salis

Usman Salis