Don't believe the "inflation is dead" narrative. While U.S. inflation isn't at its 2022 peak anymore, the latest CPI data tells a completely different story. Prices keep climbing to fresh records, and the inflation rate is still stuck above the Fed's 2% target. The reality? Higher costs aren't going anywhere.

What the Charts Really Show

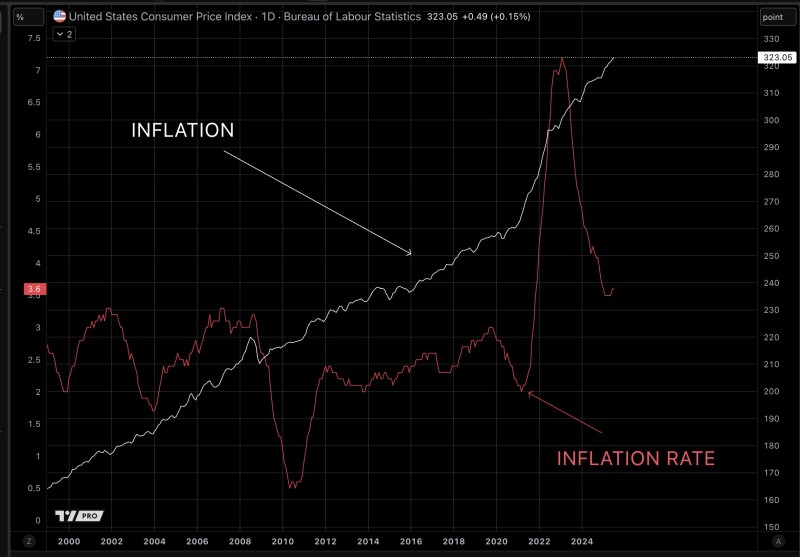

A chart shared by Alessio highlights the disconnect between public perception and actual data. The data paints a clear picture that most people are missing. The white line tracking overall prices shows a relentless march higher with no signs of stopping. Meanwhile, the red line representing the inflation rate tells its own story - sure, it's down from the crazy highs of 2021-2022, but at around 3.6%, it's still way above where it should be.

Here's what's really happening: even when inflation "cools," prices don't magically drop. They just rise slower. That's why your grocery bill still hurts and rent keeps eating up more of your paycheck.

Why Prices Won't Back Down

This isn't some temporary blip that's going away. Energy shocks from the pandemic and geopolitical mess created lasting damage. The job market is still red-hot, pushing up wages and service costs, especially in housing and healthcare. And here's the kicker - those interest rate hikes everyone's talking about? They take months, sometimes years, to actually cool things down.

Here's what policymakers don't want to admit: inflation adds up. Once prices jump, they almost never come back down. So even if the rate of increase slows, you're still paying record prices for everything. That "cooling" inflation rate doesn't mean relief is coming - it just means things are getting expensive at a slightly slower pace.

The Bureau of Labor Statistics data doesn't lie. While headlines celebrate slower inflation growth, the CPI's steady climb proves the cost of living crisis isn't over. For anyone trying to make ends meet, invest wisely, or run a business, this inflation fight is just getting started.

Usman Salis

Usman Salis

Usman Salis

Usman Salis