The Federal Reserve thought it had inflation expectations under control. Then the latest Common Inflation Expectations (CIE) Index data dropped, showing a troubling climb that threatens to undermine everything Jerome Powell said at Jackson Hole. What was supposed to be a reassuring message about the Fed's inflation-fighting resolve now looks increasingly disconnected from market reality.

This isn't just another economic indicator moving higher—it's a direct challenge to the Fed's credibility at the worst possible time. With Powell having just finished his carefully crafted Jackson Hole speech, the timing couldn't be more awkward.

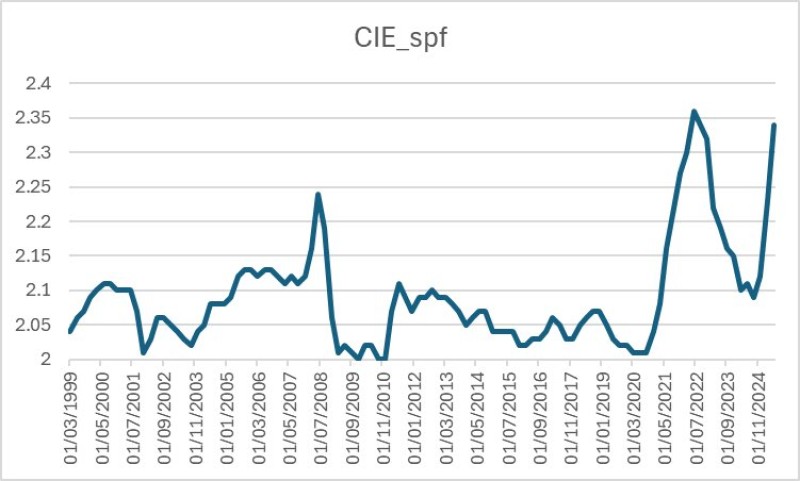

CIE Index Price at 2.35 Raises Alarm

The numbers don't lie. According to market analyst @INArteCarloDoss, the CIE Index is pushing toward 2.35—territory we haven't seen since the inflation chaos of 2021-2022. To put that in perspective, this thing used to sit comfortably between 2.05 and 2.15 for most of the 2000s. When it spikes like this, it's usually because something's gone wrong.

And here's the kicker: every major surge in this index has coincided with either financial meltdowns or runaway inflation. The current move suggests people aren't buying what the Fed is selling about getting prices back under control.

Talk about bad timing. Powell spent his Jackson Hole speech trying to convince everyone that the Fed had inflation handled and was ready to stick to its 2% target. Then boom—the CIE data comes out and makes him look like he's living in a fantasy world.

This creates a real credibility problem. When your own inflation expectations gauge is screaming one thing while you're saying another, markets start to wonder who's really in charge here.

Market Impact of Rising CIE Price

Here's where things get interesting for traders. If the CIE stays above 2.30, we're looking at some serious market reshuffling. Treasury yields are already climbing as investors demand bigger returns to compensate for inflation risk. Stocks are getting jittery because nobody knows what the Fed will do next.

The real nightmare scenario? The CIE holds near 2.35 and forces Powell's hand. Suddenly, all those rate cut hopes markets have been pricing in start looking way too optimistic.

Historical Context: Why the CIE Matters

This index has quite the track record. It crashed during the 2008 crisis when everyone thought deflation was the bigger threat, then spent years slowly crawling back to normal. For nearly a decade, it was the picture of stability—boring, predictable, exactly what central bankers love to see.

Then 2021 happened, and it went haywire alongside actual inflation. The fact that it's climbing again, even after the Fed's aggressive rate hikes, tells you everything about how hard it is to put this genie back in the bottle. Expectations, once unmoored, don't just snap back into place because someone gives a nice speech.

Peter Smith

Peter Smith

Peter Smith

Peter Smith