Think of stablecoins as the unsung heroes of crypto. While Bitcoin and Ethereum grab headlines, it's coins like Tether (USDT) that actually keep the wheels turning. They're the bridge between the wild west of crypto volatility and the steady world of traditional finance. And right now, USDT isn't just winning—it's dominating in a way that's reshaping how money moves around the globe.

USDT Transaction Volume Surges on TRON

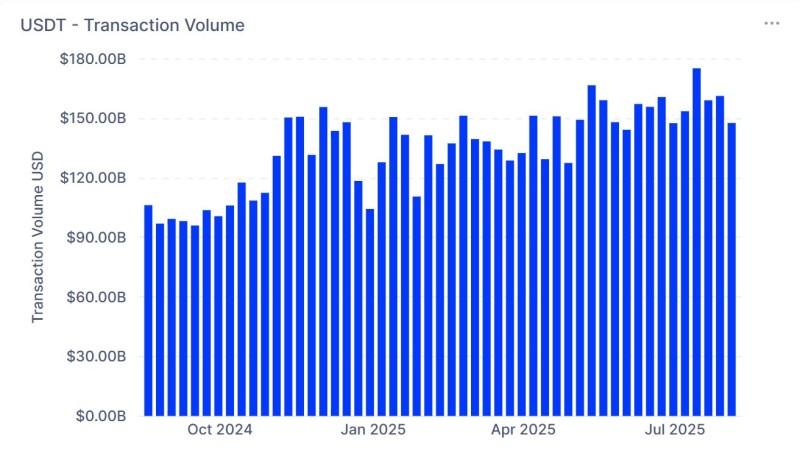

Here's a number that'll make you do a double-take: $150 billion. That's how much value flows through USDT on TRON every single month. To put that in perspective, that's more than the GDP of most countries.

As highlighted by trader @Defi_lord002, USDT isn’t just a stablecoin—it has grown into a global settlement infrastructure. With $83 billion in circulation and over $150 billion in monthly transactions, USDT on the TRON network has established itself as the most reliable and widely adopted payment rail in the digital asset space.

The growth trajectory tells the story. Through 2024 and into mid-2025, the numbers keep climbing. This isn't speculative trading—it's real people and businesses using USDT to actually move money around.

TRON and USDT: Building Liquidity Infrastructure

Why TRON? Simple: it works. While other blockchains get clogged up or charge crazy fees, TRON keeps humming along with cheap, fast transactions. It's like having a superhighway when everyone else is stuck on back roads.

Projects are starting to notice. Take JUST, for example—they're not just sitting on this massive flow of money, they're putting it to work. DeFi lending, yield farming, sophisticated financial products—all built on top of this USDT foundation. It's turning everyday stablecoin transfers into the building blocks of a new financial system.

Market Implications for USDT Price and Stability

Let's be clear: USDT's price isn't going anywhere. It stays at $1, and that's exactly the point. But what matters is everything happening underneath that stable surface.

Institutions are paying attention. When you need to move serious money without worrying about Bitcoin dropping 10% while your transaction clears, USDT is your go-to. Traders treat it like digital cash, hopping between exchanges and DeFi protocols without missing a beat.

The real kicker? If regulators finally get their act together and create clear rules for stablecoins, USDT could explode even more. With numbers like these already, imagine what happens when the last barriers come down.

Peter Smith

Peter Smith

Peter Smith

Peter Smith