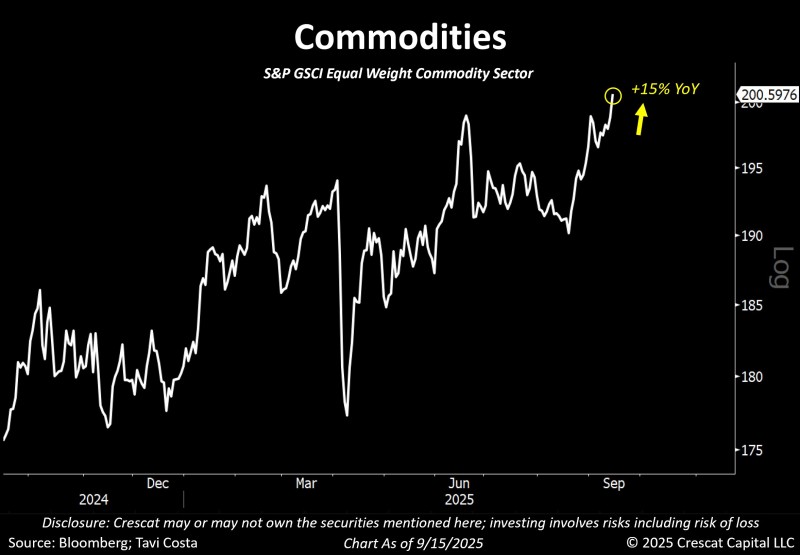

A striking disconnect is emerging between Federal Reserve policy and market dynamics. While commodities have surged 15% over the past year and hit fresh highs, the central bank is signaling upcoming rate cuts. This unusual combination highlights what many analysts see as financial repression in action - a scenario where policymakers ease monetary conditions even as inflation pressures build, ultimately penalizing savers and cash holders.

Commodities Rally Despite Policy Shift

Trader Otavio (Tavi) Costa has pointed to this situation as a textbook example of financial repression, where loose monetary policy coincides with rising prices across commodity markets.

The phenomenon echoes Ray Dalio's famous warning that "cash is trash," as holding cash becomes increasingly risky when real yields turn negative. The S&P GSCI Equal Weight Commodity Index has been on a steady climb since late 2024, reaching approximately 200.6 by September 2025. Despite some volatility with pullbacks in March and June, the index has maintained higher lows throughout the year, demonstrating resilient demand and fresh breakout momentum above mid-year resistance levels.

Market Forces Behind the Rally

Multiple factors are converging to drive commodity prices higher. Inflationary pressures continue building across energy, agriculture, and metals markets, while the Fed's dovish pivot appears misaligned with these price trends. Supply-side constraints from geopolitical tensions and ongoing logistics challenges are providing additional support for commodity pricing. Meanwhile, institutional investors are increasingly rotating into hard assets as a hedge against declining real yields and currency debasement concerns.

Investment Implications

The current environment presents clear challenges and opportunities for different types of investors. Savers face the prospect of cash yields falling below inflation rates, effectively eroding purchasing power over time. Active traders and portfolio managers are finding opportunities in commodities, precious metals, and energy-related equities that may continue outperforming traditional assets. However, the Fed's easier monetary stance could extend the commodity rally while simultaneously heightening inflation risks, potentially complicating future policy decisions.

Looking Ahead

The 15% year-over-year gain in commodities alongside Fed rate cut signals represents a defining moment in current market dynamics. For investors, the message is becoming increasingly clear: real assets are gaining ground while cash positions face mounting risks from inflation and negative real yields. The critical question facing markets now is whether commodities will emerge as the primary hedge for the next market cycle, as traditional safe havens lose their appeal in an environment of financial repression.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah