The cryptocurrency market is witnessing a fascinating phenomenon as Bitcoin (BTC) becomes increasingly scarce on major exchanges. With reserves plummeting to levels not seen since 2018, this supply contraction is happening precisely as Bitcoin maintains its position above the psychologically significant $115,000 mark. This convergence of reduced availability and sustained high prices suggests we may be approaching a pivotal moment that could reshape Bitcoin's price dynamics in the months ahead.

Bitcoin Supply Drain Intensifies

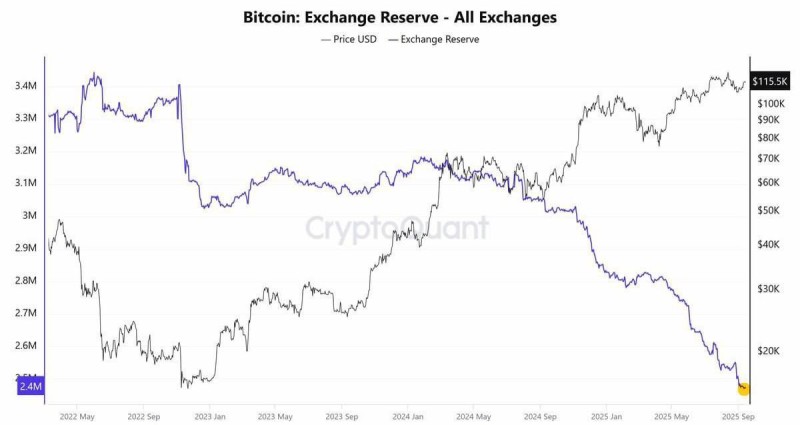

Bitcoin is becoming scarcer on exchanges than at any time in the past seven years. Exchange balances have dropped to 2.4M BTC, even as the price hovers above $115,500. According to analyst Kyle Chassé, this long-term decline in available supply could set the stage for a major supply shock.

As investors move coins off exchanges into cold storage and institutional products, the liquid pool of BTC for trading keeps shrinking. This means fewer coins are available when demand surges, potentially creating more dramatic price movements during periods of increased buying pressure.

Chart Analysis: Exchange Reserves vs. Bitcoin Price

The data reveals a compelling narrative. Exchange reserves have fallen dramatically from 3.4M BTC in 2022 to just 2.4M BTC in 2025, marking a multi-year low. Meanwhile, Bitcoin's price climbed steadily over the same period, peaking near $115.5K. This inverse relationship reinforces the fundamental economic principle linking scarcity to value appreciation.

The most significant acceleration occurred during 2024-2025, where the steepest reserve decline coincided with BTC's latest surge. This timing suggests that supply tightness isn't just correlated with higher prices—it's actively amplifying upward momentum.

Market Forces Behind the Decline

Several structural shifts are driving this transformation:

- Long-term holding patterns: Both retail and institutional investors are increasingly moving coins into cold storage for extended periods

- Institutional custody demand: ETFs and professional custody services are absorbing significant supply away from trading platforms

- Regulatory considerations: Heightened scrutiny of centralized exchanges has encouraged users to withdraw funds to self-custody solutions

- Maturation of storage infrastructure: Better cold storage options and security practices have made off-exchange holding more accessible

These combined pressures are steadily draining the tradeable supply of BTC, fundamentally altering the market's supply-demand dynamics.

Price Implications and Market Outlook

This supply contraction creates both opportunities and risks. The bullish case centers on basic economics - if demand remains steady while available supply shrinks, prices naturally trend higher. However, reduced exchange balances also mean thinner order books, which could amplify volatility in both directions.

The $115K-$116K range has emerged as a critical technical zone. A decisive breakout above this level could trigger accelerated buying as supply constraints become more apparent. Conversely, any significant selling pressure would quickly test how efficiently the market can absorb available coins at lower prices.

Usman Salis

Usman Salis

Usman Salis

Usman Salis