Global currencies are quietly losing value while traditional investments struggle to keep pace with real inflation. Even when crypto investors earn attractive yields, currency depreciation often cuts their actual returns in half. This reality has sparked an interesting question: should DeFi platforms like Solana offer stablecoins backed by stronger currencies like the Swiss franc?

Trader on Why CHF Is "the Gold of Forex"

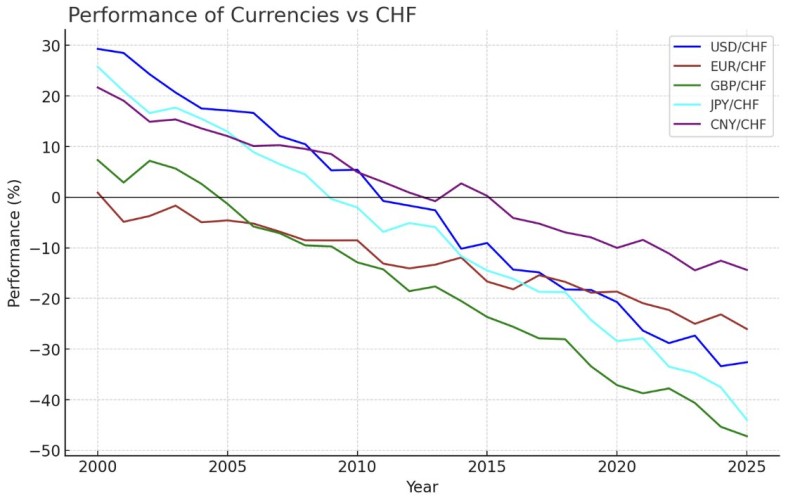

Trader @FabianoSolana points out a striking pattern: most major currencies drop about 5% yearly against the Swiss franc. His data shows USD, EUR, GBP, JPY, and CNY have all weakened 30-50% against CHF since 2000.

This creates a frustrating reality for investors. You might earn 10% yield in dollars, but inflation and currency weakness can easily cut those gains in half. CHF's consistent strength has earned it the nickname "the gold of forex" among traders who value stability over volatility.

Why Solana DeFi Could Benefit from a CHF Stablecoin

A Swiss franc-backed stablecoin on Solana makes sense for several reasons:

- Inflation hedge: Protection against USD and EUR devaluation

- Long-term stability: Appeals to users focused on wealth preservation

- Market differentiation: Few DeFi platforms offer CHF exposure

With Solana DeFi seeing $1.3B+ in weekly volume and growing institutional adoption, a CHF stablecoin could attract investors seeking real value protection rather than just high yields.

Usman Salis

Usman Salis

Usman Salis

Usman Salis