SEI has caught the attention of crypto traders as it maintains its position above critical support levels while forming a promising technical pattern. The altcoin's recent price action suggests that a significant move could be on the horizon, making it a focal point for both short-term traders and long-term investors looking for the next breakout opportunity.

SEI Price Defends Key Support Zone

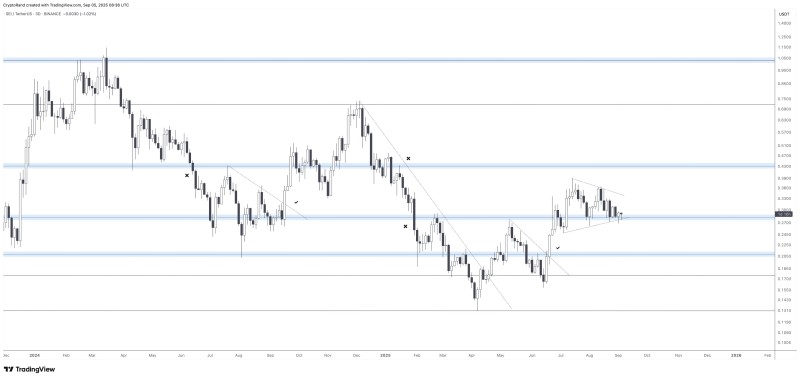

SEI has reached a pivotal moment as it continues to hold above the strong support confluence around $0.27–$0.30. The price action has formed a tightening bull pennant pattern, which typically signals an impending continuation of the previous uptrend. @crypto_rand highlighted this setup as offering exceptional risk-to-reward potential.

With limited downside risk and significant upside possibilities, SEI has become a top contender on many traders' watchlists during this consolidation phase.

Technical Pattern Points to Potential Breakout

The bull pennant formation that SEI is currently displaying represents a classic continuation pattern in technical analysis. This consolidation phase typically occurs after a strong upward move, allowing the asset to gather momentum before the next leg higher. The narrowing price range indicates that a breakout decision is approaching.

Market participants are closely monitoring volume patterns and price action around the pennant's boundaries. A breakout accompanied by strong volume would provide additional confirmation of the bullish scenario that many traders are anticipating.

Price Targets and Strategic Levels

Should SEI successfully break above the $0.33–$0.35 resistance zone, the path toward $0.43 would likely open up for short-term traders. A sustained rally beyond that level could potentially extend gains into the $0.50–$0.60 range, representing substantial upside from current levels.

However, traders remain cautious about the downside scenario. If the $0.27 support fails to hold, the bullish outlook could be compromised, potentially sending SEI back toward the $0.22–$0.20 support area.

Market Sentiment and Risk Management

The current setup presents an interesting opportunity for traders willing to manage risk carefully. The tight consolidation above key support levels, combined with the bull pennant formation, creates a scenario where the potential reward significantly outweighs the risk for those entering with proper stop-loss placement.

As SEI approaches this critical juncture, market participants are preparing for either scenario while keeping a close eye on broader market conditions that could influence the breakout direction. The coming sessions will likely determine whether this technical setup delivers on its bullish promise.

Peter Smith

Peter Smith

Peter Smith

Peter Smith