The US economy is starting to send some mixed signals that have economists and investors on edge. What we're seeing is a labor market that's losing steam while inflation refuses to go away quietly. This combination is creating the kind of economic headache that policymakers dread - and it's bringing back memories of the stagflation era from the 1970s. The latest jobs data paints a picture that's getting harder to ignore.

Weak Job Growth Signals Trouble

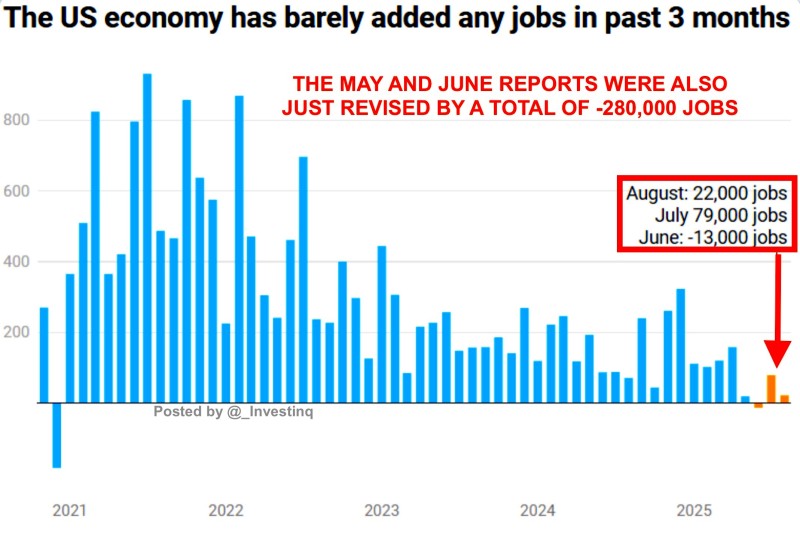

The numbers coming out of the labor market are pretty concerning. August saw just 22,000 new jobs created - that's barely a blip compared to what we're used to seeing. July wasn't much better with 79,000, and June actually went backwards with -13,000 jobs lost. To make matters worse, they went back and adjusted the May and June numbers down by a whopping -280,000 jobs combined.

What's really worrying traders like @_Investinq is that we're seeing this job market weakness even after months of the Fed raising interest rates to cool things down. Usually, you'd expect inflation to come down as the economy slows, but that's not happening. Instead, we're getting the worst of both worlds - fewer jobs being created while prices stay stubbornly high.

Stagflation – The Fed's Worst Nightmare

The Federal Reserve is stuck in a really tough spot right now. If they keep raising rates to fight inflation, they risk making the job market even worse and potentially pushing unemployment way up. But if they start cutting rates to help the economy, they might just give inflation another reason to stick around or even get worse.

This is exactly the kind of scenario that keeps central bankers up at night. When job growth is falling apart but inflation won't budge, there's no easy answer. Every move they make could backfire.

We're not just talking about stagflation as some distant threat anymore - it's actually starting to happen. With hiring slowing down, prices staying high, and people spending less, we could be looking at years of sluggish growth mixed with elevated costs for everything.

For anyone invested in the markets, this means we're probably in for a bumpy ride. Expect more ups and downs, more uncertainty about where things are headed, and pressure on stocks and other risky investments as people try to figure out what comes next.

Peter Smith

Peter Smith

Peter Smith

Peter Smith