The crypto world loves a good mystery, and Ethereum (ETH) just delivered one of the biggest whale moves of 2025. While everyone was panicking about potential ETH sell-offs and mass staking exits, something unexpected happened - the trend completely reversed. Now we're seeing more people rushing to stake their ETH than unstake it, and a legendary whale from Ethereum's early days just made a move that's got everyone talking. Could this be the signal that ETH is ready for its next big run?

ETH Staking Queues Flip as Sell-Off Fears Fade

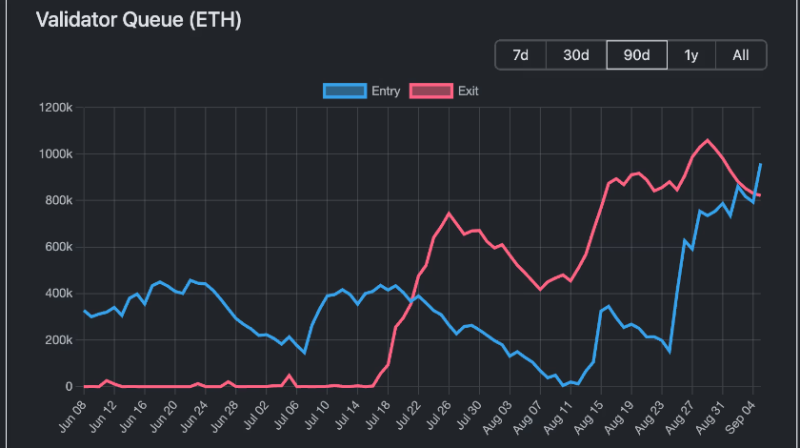

Something big is happening with Ethereum staking right now. For the first time in weeks, more people want to stake their ETH than unstake it - and that's actually a pretty big deal.

The numbers tell the story: 932,936 ETH ($4 billion) is sitting in the entry queue, while only 791,405 ETH ($3.3 billion) wants out, according to validatorque.com data. Just three weeks ago, the exit queue was packed with 816,000 ETH, and everyone was freaking out about a potential sell-off.

But here's the kicker - that sell-off never really happened. ETH is down just 4% since August 15, while Bitcoin dropped 7% and most altcoins got hammered with double-digit losses. So much for the doom and gloom predictions.

Mystery ETH Whale Emerges After 8 Years to Stake $645M

The plot thickens with one of the most incredible whale moves we've seen this year. An original Ethereum ICO participant - someone who's been sitting on their tokens since 2014 - suddenly decided to stake 150,000 ETH worth $645 million.

Get this: this person originally bought 1 million ETH for just $310,000 during Ethereum's 2014 token sale. That's like buying a lottery ticket that actually won. Even after staking that massive chunk, they're still holding onto another 105,000 ETH ($451 million) across two wallets.

When someone who's been hodling for eight years suddenly decides to lock up that much money in staking, you've got to wonder what they know that we don't.

Why This ETH Price Prediction Looks Bullish

Here's what makes this whole situation interesting for ETH's price outlook. Staking essentially takes tokens off the market - less supply usually means higher prices if demand stays steady or grows.

As DeFi analyst Ignas pointed out back in August: "While the unstaking queue is at ATH, so are ETF inflows." That observation is looking pretty smart right now. We're seeing exits cool down while entries heat up, and that's exactly the kind of dynamic that could push prices higher.

The fact that ETH held up so well during the recent crypto carnage shows the staking mechanism might be working as intended - providing a floor when things get messy. With more institutional money flowing in through ETFs and whales like our mystery friend committing to long-term staking, the setup for ETH looks increasingly solid heading into the rest of 2025.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah