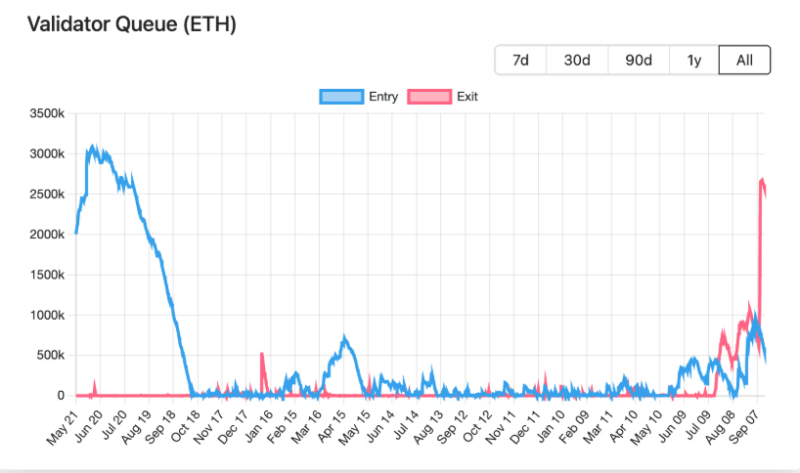

Over 2.5 million Ethereum (ETH) tokens are trapped in Ethereum's worst-ever validator bottleneck, creating a massive $11.25 billion logjam that's pushing exit times to an unprecedented 46 days. This crisis could trigger serious price volatility as frustrated stakers scramble for the exits.

What's Behind ETH's Record-Breaking Validator Crisis

Ethereum just hit a breaking point. Right now, about 2.5 million ETH tokens - worth roughly $11.25 billion - are stuck waiting to leave the validator system. The wait time? A mind-blowing 46 days, which completely destroys the previous record of 18 days from August.

This mess started on September 9th when Kiln, a major infrastructure provider, decided to pull the plug on all their validators. Why? They got spooked by recent security breaches, including the NPM supply-chain attack and SwissBorg hack. Even though these attacks had nothing to do with Ethereum's staking system, Kiln wasn't taking any chances and yanked about 1.6 million ETH from the network all at once.

But it's not just about security fears. ETH has been on fire lately, surging over 160% since April. So naturally, a bunch of stakers are cashing out their profits. Plus, big institutional players are reshuffling their portfolios, adding even more pressure to the exit queue.

The Perfect Storm Brewing for ETH Price Action

Here's where things get really interesting. While everyone's trying to get out, there's actually a flood of new validators trying to get in. The SEC cleared up some confusion in May, saying that staking isn't a security, which got institutions excited again. And with ETH ETFs potentially on the horizon, funds are scrambling to position themselves for regulated staking yields.

Ethereum has this built-in speed limit called the "churn limit" that caps validator exits at 256 ETH every 6.4 minutes. It's designed to keep the network stable, but right now it's creating a massive traffic jam. With 2.5 million ETH in line, people who joined the queue on Wednesday are looking at 44 days just to start the exit process.

Benjamin Thalman from Figment thinks most of this ETH won't actually leave for good - about 75% will probably get restaked under new validators. That means nearly 2 million ETH could slam into the entry queue once these exits clear, creating chaos on both sides.

ETH Price Could Face Months of Queue Chaos

The math gets pretty scary when you look ahead. Right now, the entry queue is 13 days. But Thalman crunched some numbers that'll make your head spin. Add the 2 million ETH from current exiters (35 days) plus an estimated 4.7 million ETH from potential ETFs (81 days), and you're looking at 129 days total. That's assuming nobody else decides to jump in line.

"The activation queue is currently 13 days, to this add the ~2M ETH from those currently exiting (35 days) and 4.7M from ETFs (81 days), and the total is 129 days. This assumes that there are no other ETH holders that choose to stake and enter the queue, like corporate treasuries," Thalman wrote.

What's wild is that Ethereum is actually working exactly as it should. The network is just experiencing growing pains as it becomes more institutionalized. Security scares, profit-taking, and regulatory changes are all colliding at once, creating this perfect storm that could shake up ETH prices for months to come.

Peter Smith

Peter Smith

Peter Smith

Peter Smith