After months of economic turbulence and fluctuating price levels, the eurozone has achieved a notable milestone. European inflation held firm at 2% in August, perfectly aligning with the European Central Bank's long-term target. This stability brings welcome relief to policymakers who have been grappling with the delicate balance between controlling prices and supporting economic growth.

Current Inflation Data and Trends

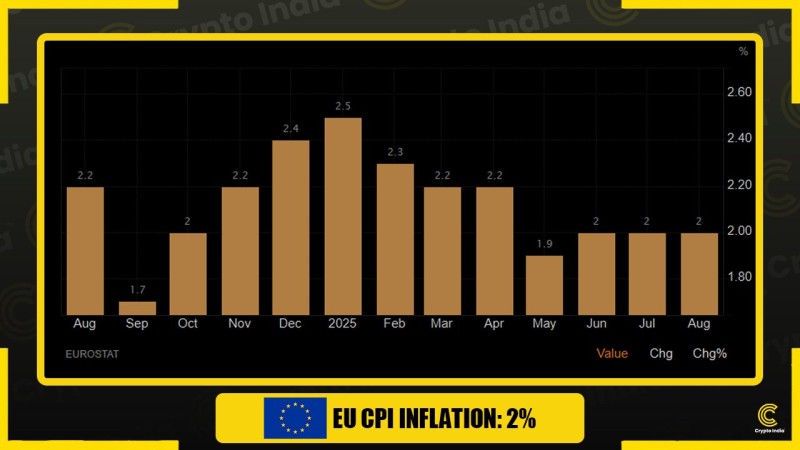

Market analysis from Crypto India and other financial experts shows that Eurostat's Consumer Price Index data for August 2025 came in exactly at 2%, unchanged from July and slightly below market expectations of 2.1%. This represents the third straight month of inflation sitting right at the ECB's target level.

The recent inflation trajectory tells an interesting story. Earlier this year saw inflation peak at 2.5% in January, followed by a gradual decline through spring that bottomed out at 1.9% in May. Since June, however, the rate has stabilized at the 2% mark, suggesting that price pressures have found a new equilibrium.

Market Response and ECB Policy Outlook

This sustained period of target-level inflation significantly reduces pressure on the European Central Bank to implement additional tightening measures. With growth remaining fragile across the eurozone, further interest rate increases could potentially undermine recovery efforts. The stable inflation environment supports equity markets, particularly benefiting consumer and retail sectors, while also creating a more predictable landscape for bond investors.

Economic Implications and Future Challenges

While achieving the 2% target represents a clear policy success, maintaining this stability presents ongoing challenges. Energy price volatility, wage inflation pressures, and shifting global trade dynamics all threaten to disrupt the current equilibrium. The ECB's enhanced credibility from hitting its target must now be balanced against the risk of external price shocks that could quickly change the inflation landscape.

Looking Ahead

The eurozone appears to have entered a period of genuine price stability that could boost consumer confidence and encourage investment flows. However, several factors will be crucial to monitor in the coming months, including winter energy demand patterns, evolving geopolitical tensions, and potential external economic shocks. While the ECB can reasonably claim success with inflation anchored at target levels, the challenge of maintaining this balance in an uncertain global environment remains ever-present.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah