Ethereum is displaying one of the most compelling on-chain narratives of the current market cycle. As prices climb past $4,700, a dramatic shift is happening behind the scenes—investors are pulling their ETH off exchanges at historic rates, creating conditions that could spark the next major price surge.

Ethereum (ETH) Price and Vanishing Exchange Supply

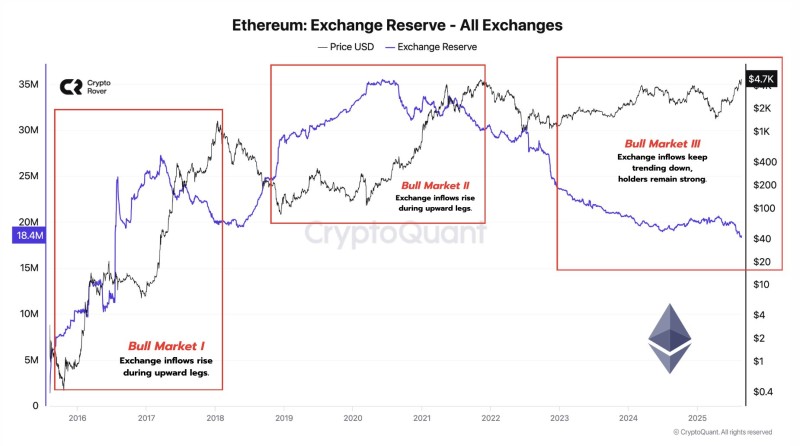

Something remarkable is happening with Ethereum's supply dynamics. Exchange reserves have collapsed to just 18.4 million ETH—the lowest level we've seen in years, according to CryptoQuant data. This isn't just a minor blip; it represents a fundamental change in how investors are treating their ETH holdings.

Crypto analyst @rovercrc pointed out a striking pattern: during the 2017-2018 and 2020-2021 bull runs, people typically moved their ETH to exchanges when prices rose, ready to cash out. But this cycle tells a completely different story. Even as ETH prices climb, holders are doing the opposite—they're moving coins away from exchanges and into cold storage.

Why This Cycle Looks Different for Ethereum (ETH)

The current bull market stands apart from its predecessors in one key way: accumulation behavior. While previous cycles saw exchange inflows spike during rallies as traders rushed to sell, today's investors are playing a different game entirely.

The data tells the story clearly. In Bull Markets I and II, rising prices meant rising exchange inflows. But in our current Bull Market III (2023-2025), exchange reserves keep shrinking even as ETH pushes above $4,700. This suggests investors aren't just riding short-term waves—they're positioning for something bigger.

Usman Salis

Usman Salis

Usman Salis

Usman Salis