Silver mining stocks are capturing significant market attention as precious metals regain their luster in today's economic climate. The Global X Silver Miners ETF (SIL) has become a focal point for investors seeking exposure to this sector, delivering impressive returns that have nearly doubled over the past year. This latest breakout signals potential continuation of the silver mining rally.

Silver Miners Spark Investor Excitement

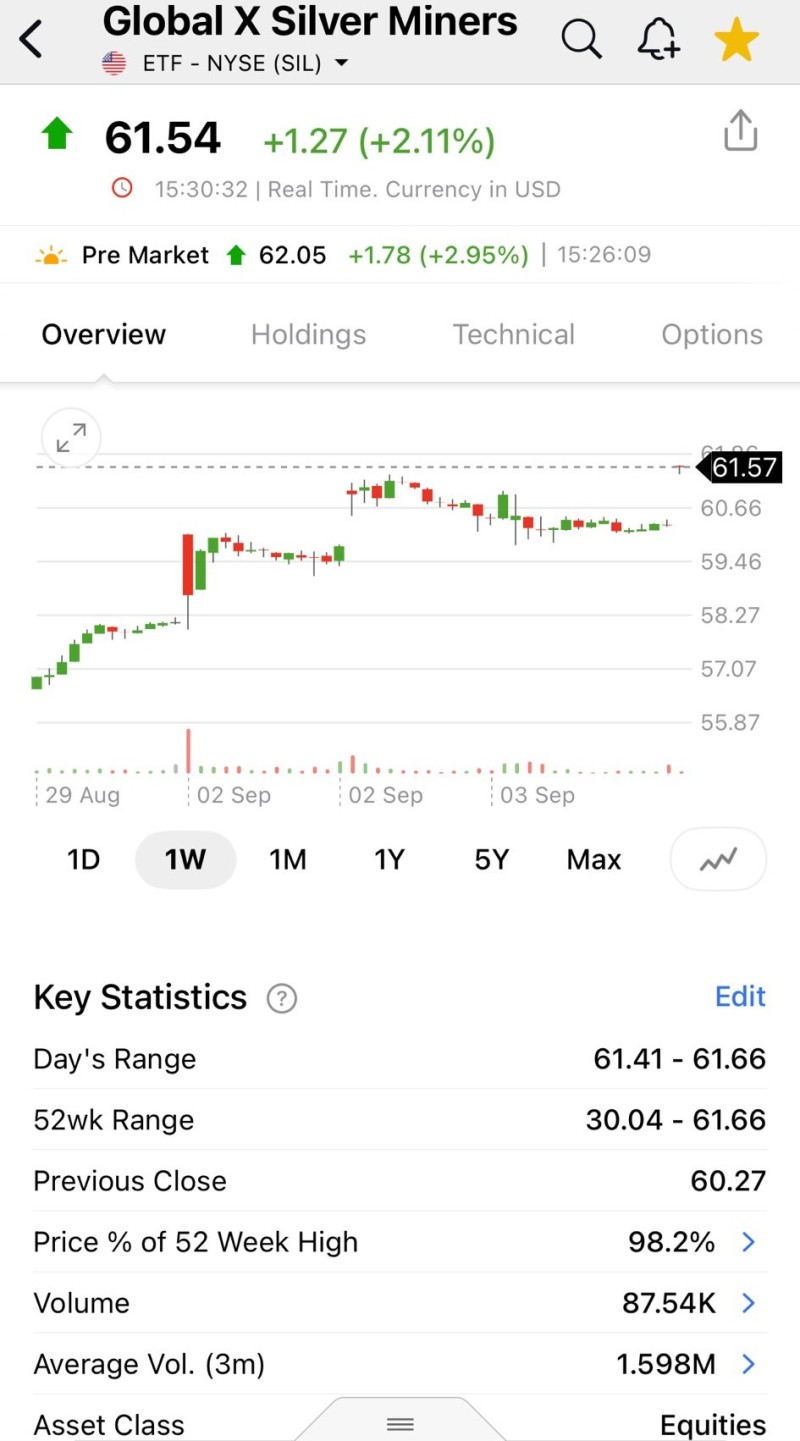

Precious metals have returned to center stage as the Global X Silver Miners ETF (SIL) struck a fresh 52-week high at $61.54, posting a solid +2.11% daily gain. This move demonstrates renewed market appetite for silver mining stocks, which typically offer amplified exposure to underlying silver price movements.

Prominent trader @clkleinmonaco flagged this breakout, emphasizing that silver miners now occupy the upper reaches of their annual trading range. His observations reflect growing bullish sentiment around mining equities as investors seek portfolio protection amid ongoing economic uncertainty.

Strong Technical Position Emerges

Market data supports SIL's impressive momentum. The ETF maintained a tight trading range of $61.41 – $61.66, finishing near session highs. At 98.2% of its 52-week peak, SIL demonstrates near-record strength.

Pre-market activity pushed SIL to $62.05 (+2.95%), indicating continued buying interest. Daily volume of 87.54K remained below the three-month average of 1.598M, suggesting institutional investors could drive additional upside. The 52-week span from $30.04 to $61.66 illustrates the sector's remarkable transformation over twelve months.

Rally Drivers Remain Intact

Multiple tailwinds continue supporting silver miners:

- Expanding industrial silver demand from technology and green energy sectors

- Persistent inflation concerns driving precious metals investment

- Investor preference for mining stocks as higher-beta commodity exposure

SIL functions as a sector bellwether, tracking global silver producer performance while amplifying spot silver trends.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah