Tesla is making headlines again this week, and it's not just about electric vehicles. The stock jumped 3.64% to close at $350.84, outperforming most major tech names while broader markets struggled. What's really got investors talking is a bombshell report from The Wall Street Journal about Tesla's board considering a massive compensation package for Elon Musk that could reach $1 trillion over the next decade. It's the kind of news that reminds everyone just how central Musk is to Tesla's story.

Technical Picture Shows Promise

According to analyst @Aison_Walker, Tesla is definitely the stock to watch this week, with both the technical setup and news flow pointing toward some potentially big moves ahead.

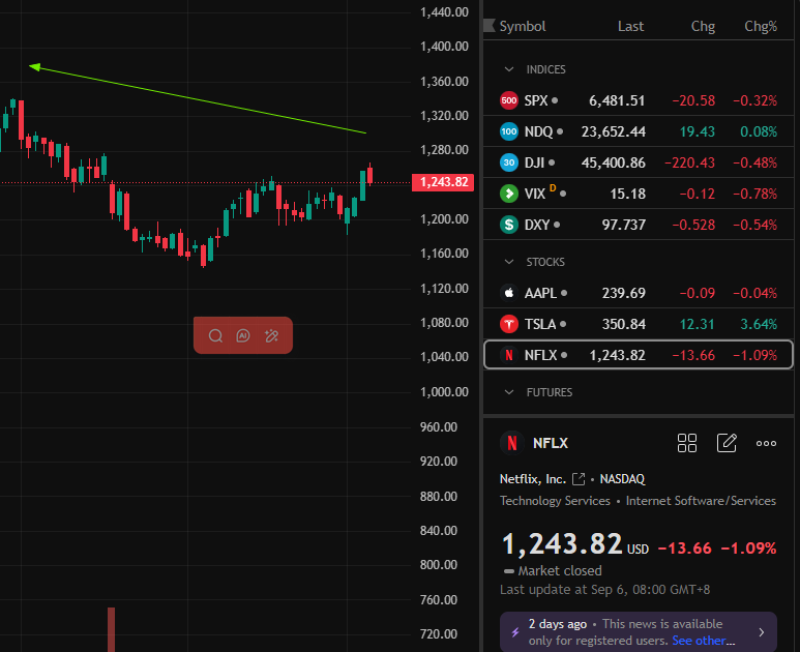

Despite the broader market selling off, Tesla is holding up surprisingly well. At $350.84, it posted one of the strongest performances among large-cap tech stocks in the recent session. While the longer-term trend still looks a bit shaky, the stock has bounced nicely from that $300–$320 support area where it found buyers.

The key level everyone's watching is $360–$370 overhead resistance. If Tesla can punch through that zone, we could see a run toward $400 and beyond. What's encouraging is that the stock has been making higher lows in recent sessions, suggesting buyers are getting more confident. The missing piece is volume, but if that picks up, we could see a real momentum shift.

What's Driving the Move

The elephant in the room is obviously Musk's proposed pay package. A $1 trillion compensation deal might sound crazy, but it shows just how much Tesla's board believes in Musk's vision for the company's future. It's also a reminder of how closely tied Tesla's success is to its CEO.

Beyond the headlines, Tesla outperformed while the S&P 500 dropped 0.32% and the Dow fell 0.48%. The company continues to lead the global EV revolution, and despite tougher competition, demand trends remain solid.

The Bull and Bear Cases

Key levels to watch:

- Support: $340 needs to hold to keep the recovery intact

- Resistance: $360–$370 is the make-or-break zone

- Upside target: $400+ if momentum really kicks in

- Downside risk: $320 or even $300 if support fails

If Tesla breaks decisively above $370, it would confirm that the trend is turning and momentum could carry it much higher. On the flip side, if the stock can't stay above $340, we might see it drift back toward $320 or even test that $300 support again.

Usman Salis

Usman Salis

Usman Salis

Usman Salis