Tesla (TSLA) shares gained strong momentum in Friday's trading session, driven by a combination of product launches and operational achievements. The stock demonstrated resilience, bouncing back from early session lows and settling near important technical resistance levels. This price movement reflects growing investor confidence in Tesla's diversified growth strategy and execution capabilities.

Tesla Stock Analysis: Momentum Builds on New Developments

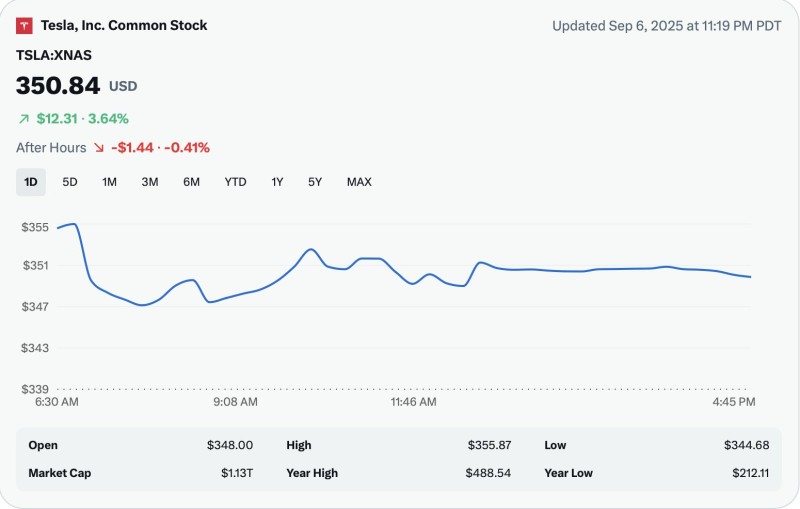

Tesla (TSLA) finished the day at $350.84, gaining $12.31 (+3.64%) before dropping $1.44 (-0.41%) in after-hours trading. Analyst @Teslawhatsnew noted that the rally was supported by multiple positive catalysts throughout the session.

The strong performance highlighted Tesla's ability to deliver on both innovation and operational milestones.

Key Stats:

- Open: $348.00

- High: $355.87

- Low: $344.68

- Market Cap: $1.13 trillion

- Year High: $488.54

- Year Low: $212.11

The stock started slightly higher, dipped to around $344 early on, then rallied to test resistance near $356. TSLA spent the afternoon in a narrow trading range, showing consistent buying interest.

The day's gains coincided with several strategic announcements that reinforced Tesla's growth narrative across multiple business segments.

Model Y Performance Launch in Europe

Tesla launched its Model Y Performance edition in Europe, strengthening its position in a crucial EV market. The enhanced version features upgraded performance specs and refined design elements, positioning Tesla to capture more market share in the region's expanding electric vehicle segment.

Robotaxi App and Giga Texas Expansion

Tesla made headlines by launching its Robotaxi app on Apple's App Store, marking tangible progress toward its autonomous transportation goals. This move demonstrates Tesla's commitment to expanding beyond traditional vehicle sales into next-generation mobility services.

At the same time, Tesla's Giga Texas facility reached impressive production milestones, with reports indicating the plant now produces one Model Y per minute. A new Delivery Center at the facility is also nearing completion, further boosting Tesla's manufacturing and distribution capabilities.

Chart Insights: Support and Resistance

Friday's trading revealed key technical levels:

- Resistance: The $355–$356 zone limited upside gains. Breaking above this level could open a path toward $360+.

- Support: Strong buying emerged around $344–$348 after the early session dip.

- Trend: The recovery from session lows suggests institutional interest, backed by the day's positive catalysts.

This setup leaves Tesla at a critical juncture—either consolidating around current levels or preparing for another upward move.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah