NIO stock just delivered its strongest performance in weeks, surging across both major trading venues. Hong Kong investors pushed shares up nearly 6% while U.S. traders added over 4% overnight. This isn't just another random bounce - the dual-market strength suggests something bigger is happening with Chinese EV sentiment, and the technical setup looks increasingly bullish.

The Numbers Behind the Move

The bullish update was shared by trader Steve-DOGE-NIO, who pointed to the positive tone across both listings as a sign of building confidence in the company’s outlook.

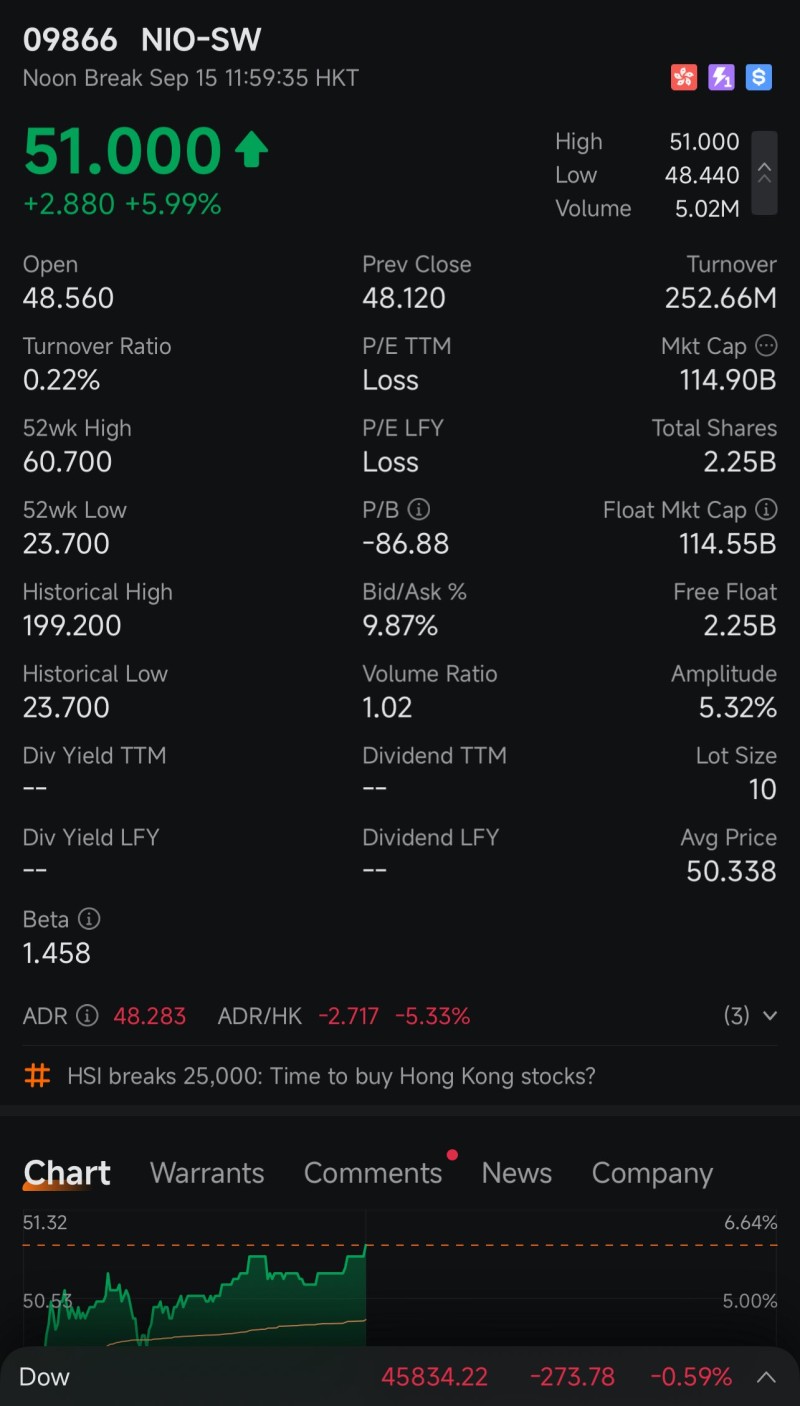

NIO Inc. (NYSE: NIO; HKEX: 9866) kicked off the week with serious momentum. By noon in Hong Kong, shares had climbed 5.99% to HK$51.00, while the U.S. session saw a solid 4.34% gain to $6.49. The technical picture is getting interesting too. In the U.S., NIO finally broke above those stubborn resistance levels, with key moving averages clustered around $6.40–$6.48 now acting as support. The RSI hitting 60.7 means there's still room to run before things get overbought.

Over in Hong Kong, the action was even more convincing. Trading volume hit HK$252.66M with a healthy 1.02 volume ratio, showing real institutional participation. The bounce from recent lows near HK$48.12 is giving bulls plenty of reasons to stay optimistic.

What's Driving the Surge

- Policy tailwinds: Beijing's rolling out fresh incentives for EV adoption, and the market's finally paying attention

- Value play: After months of selling pressure, NIO's trading at levels that are hard to ignore

- Risk-on rotation: Money's flowing back into growth stories, and EVs are catching the wave

The confluence of government support and technical momentum is creating a perfect setup for sustained gains.

What's Next for NIO

If NIO can hold above $6.50 USD and HK$51.00 HKD, the next logical target sits around $7.50 USD. That's not pie-in-the-sky thinking either - the technical setup supports a move that strong. But let's be real about the risks. The EV space is brutal, competition's fierce, and market volatility isn't going anywhere.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah