The cryptocurrency market rarely sleeps, and recent whale activity in XRP (Ripple) has caught the attention of traders worldwide. Over the past two weeks, large-scale investors have been quietly unloading their positions, creating ripple effects across the market. This massive distribution event offers valuable insights into institutional sentiment and potential price direction for one of crypto's most closely watched assets.

XRP Whales Unload Millions

XRP is facing fresh selling pressure as large investors, known as whales, offloaded 160 million tokens over the past two weeks. Despite this significant distribution, the price has shown surprising resilience, raising questions about whether retail demand can effectively absorb such heavy selling pressure.

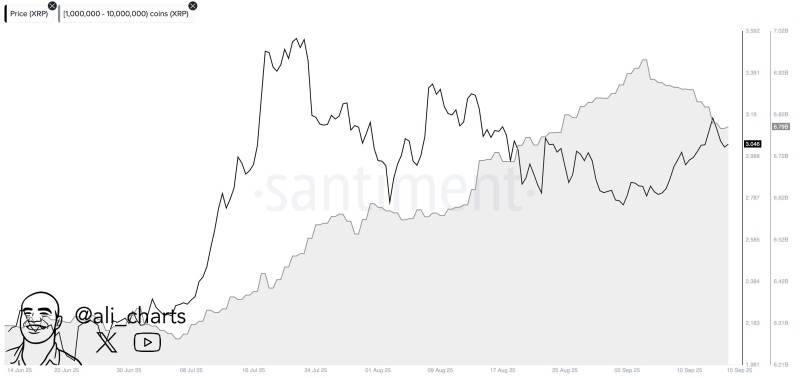

According to trader Ali, on-chain data reveals that major wallets holding between 1 million and 10 million XRP coins have reduced their balances significantly during this period.

This level of coordinated selling typically signals either profit-taking behavior or shifting market sentiment among institutional players.

Chart Analysis: Whale Activity and Price Movement

The data from Santiment clearly illustrates the relationship between whale behavior and XRP's market performance. Whale holdings, represented by the grey shaded area in typical charts, show that wallets holding between 1M–10M XRP coins surged through July and early August, peaking near 6.92 billion XRP. Since then, holdings have dropped toward 6.79 billion XRP, confirming the substantial 160 million XRP sell-off.

XRP's price movement during this same period tells an interesting story. The token rose sharply from late June through mid-July, perfectly aligning with the whale accumulation phase. However, as distribution began in August, XRP exhibited choppy price action, struggling to maintain any sustained upward momentum despite several attempts.

Key technical levels to watch:

- Support zone: $0.58–$0.60

- Resistance zone: $0.65–$0.68

- Critical break levels: $0.55 (downside) and $0.68 (upside)

The most notable aspect is the divergence between price action and whale holdings. While XRP attempts modest climbs, whale balances continue declining, suggesting that retail demand is partially absorbing the sell pressure, though upside potential remains significantly constrained.

Why Are XRP Whales Selling?

Several interconnected factors likely explain this recent whale distribution pattern. First, profit-taking appears to be the primary driver, as XRP's mid-summer rally provided whales with an attractive opportunity to lock in substantial gains after their accumulation phase in June. The timing suggests these investors are following classic institutional strategies of buying weakness and selling strength.

Market uncertainty also plays a crucial role, as broader cryptocurrency market sentiment remains cautious with Bitcoin consolidating in a narrow range and altcoins showing decidedly mixed performance. This environment often prompts large holders to reduce risk exposure during rally periods.

Additionally, the ongoing regulatory backdrop surrounding Ripple continues to create uncertainty. While recent legal developments have been generally positive, the lingering questions about regulatory clarity may encourage whales to trim their positions during favorable price movements rather than risk potential future complications.

What's Next for XRP Price?

Despite the significant selling pressure, XRP has demonstrated remarkable resilience by stabilizing around the $0.60 region. This price action suggests that underlying demand remains robust enough to absorb considerable whale distribution without triggering a major collapse.

If whales continue their distribution pattern, XRP could face additional downward pressure and potentially retest lower support levels near $0.55. However, this scenario isn't guaranteed, as the current stability indicates strong buying interest at these levels.

Conversely, should the selling pressure begin to ease, XRP could find itself positioned for a breakout above the critical $0.68 resistance level. Such a move would likely attract additional buying interest and could set the stage for renewed bullish momentum, particularly if accompanied by resumed whale accumulation.

For investors and traders, monitoring whale wallet activity remains absolutely critical. Any signs of renewed accumulation by these large holders could provide a strong tailwind for XRP price recovery and signal a shift back to bullish sentiment among institutional players.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah