The electric vehicle boom promised riches for early investors, but reality has been far messier. NIO (NYSE: NIO) perfectly captures this disconnect - a company that rode the EV hype to dizzying heights only to crash back down to earth. What started as China's answer to Tesla has become a masterclass in how financial fundamentals eventually matter more than growth stories.

The Numbers Don't Lie

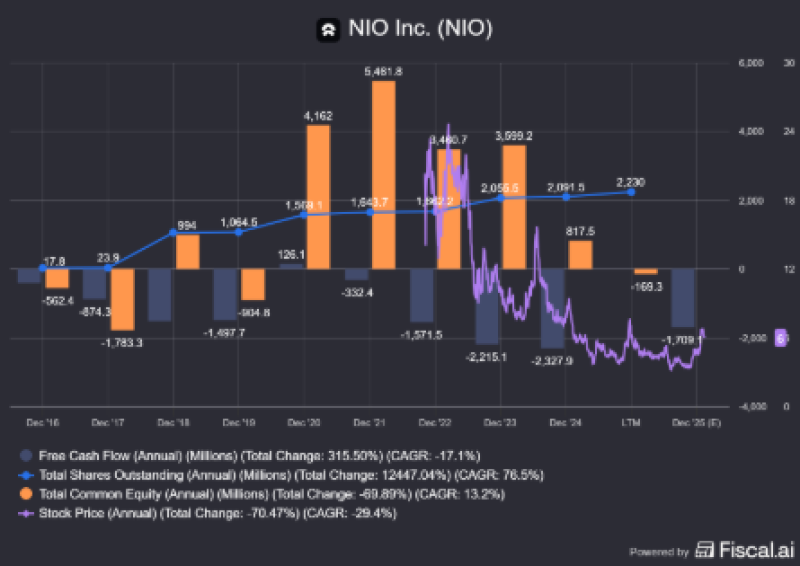

Analyst Damian Brik's recent breakdown shows exactly why NIO keeps disappointing investors. The company burns through cash every quarter while printing new shares to stay afloat, creating a vicious cycle that's decimating shareholder value. Free cash flow tells the whole story - after brief improvements in 2020-2021, NIO has consistently hemorrhaged money, including brutal outflows of $3.2 billion in 2022 and $1.7 billion in 2023. While the latest quarter showed a positive $169 million, the overall pattern remains deeply concerning.

The dilution problem is even worse. Shares outstanding have exploded at a 76.5% compound annual growth rate, meaning existing shareholders get a smaller slice of an already struggling pie. Meanwhile, total equity has dropped nearly 30%, showing how the company is leaning harder on debt while weakening its balance sheet foundation.

Stock Performance Reflects the Reality

NIO's share price perfectly mirrors these financial struggles. The stock has crashed over 70% from its peak, delivering a brutal -29.4% annual return that has wiped out billions in investor wealth. From highs above $60 during the 2021 EV frenzy to current levels under $3, the collapse has been nothing short of spectacular. Each new share issuance dilutes existing investors further, while the persistent cash burn prevents any meaningful recovery in confidence.

NIO operates in China's massive EV market, which should theoretically provide plenty of opportunity. But the company faces brutal competition from Tesla, BYD, and a host of domestic rivals who are often better capitalized and more efficient. Without a clear path to profitability that doesn't rely on constant equity raises or debt accumulation, NIO remains more speculative gamble than investment.

The fundamental question is simple: can NIO generate sustainable positive cash flow before running out of runway? Until that happens, the stock will likely remain under pressure as investors demand proof that the business model actually works.

Peter Smith

Peter Smith

Peter Smith

Peter Smith