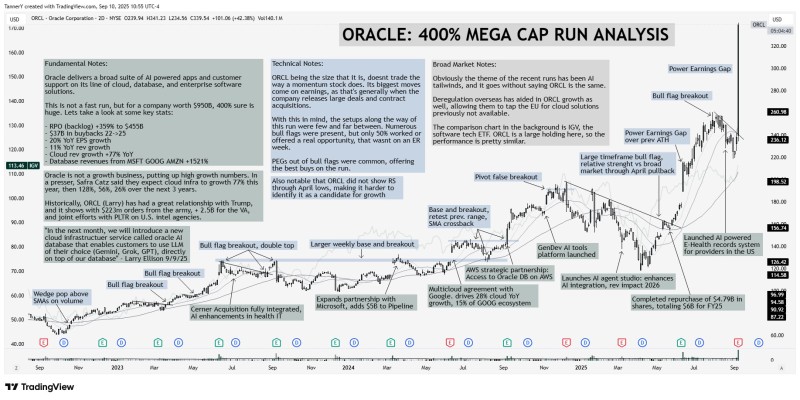

Oracle just won't quit. What started as a solid enterprise play has turned into one of tech's most explosive rallies, with shares up over 400%. The AI boom isn't just lifting boats - it's launching rockets, and Oracle's riding one straight to the top. With a market cap pushing $950 billion, the trillion-dollar question isn't if, but when.

The Numbers Don't Lie

As Tanner pointed out, these aren't just good numbers - they're game-changing numbers that show Oracle isn't just surviving the AI revolution, it's leading it.

Oracle's transformation shows up everywhere in the financials:

- Revenue backlog exploded 359% to $455 billion

- $37 billion in buybacks shrinking the share count

- Earnings per share jumped 30% year-over-year

- Total revenue climbed 11% while cloud revenue surged 77%

- Database sales to Microsoft, Google, and Amazon skyrocketed 1,521%

Technical Picture Screams Strength

The charts tell the same story as the fundamentals. Oracle's been building bull flags and breaking out of them like clockwork through 2023 and 2024. Every earnings report seems to gap the stock higher, with the latest push taking it above $260. Even when the broader market pulled back in April, Oracle showed relative strength that kept the bigger picture intact.

The pattern is clear: consolidation, breakout, repeat. That's not how old-school enterprise software companies usually trade - that's growth stock behavior.

AI Revolution Meets Enterprise Demand

Oracle's timing couldn't be better. Companies are scrambling to integrate AI into everything, and guess what they need? Databases. Cloud infrastructure. Enterprise solutions. Oracle's got all three, plus partnerships with every major cloud provider. When Amazon, Microsoft, and Google are paying you billions more for database services, you know you're in the right place at the right time.

With Oracle sitting around $950 billion in market cap, it's basically knocking on the door of the trillion-dollar club. Aggressive buybacks are shrinking the share count while revenue keeps growing. The math isn't complicated - if demand stays strong and the company keeps executing, that final $50 billion gap could close faster than most people think.

Usman Salis

Usman Salis

Usman Salis

Usman Salis