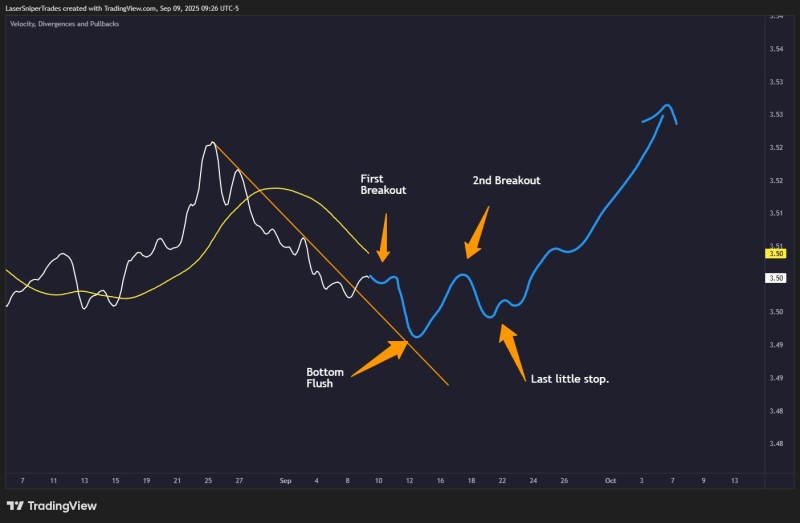

NIO has caught traders' attention again after climbing from its summer doldrums. The Chinese EV maker is painting a textbook bull flag pattern, but history suggests this might get messy before it gets beautiful.

The Pattern Playing Out

According to analysis from Laser, we're likely seeing the first breakout phase - and that usually comes with some bumps.

This isn't NIO's first rodeo with bull flags. Past setups have shown a familiar script: initial breakout energy, followed by a reality check that sends the stock back to test support around $5.92. Don't panic if that happens - it's actually part of the playbook. The key is whether NIO can hold that level and use it as a launching pad.

Critical Price Levels That Matter

- Support at $5.92: This is where the bulls need to show up. A solid bounce here keeps the pattern alive

- Resistance cluster $6.30-$6.50: Breaking through this zone would confirm the bull flag is working

- Upside targets: $7.20 and $7.60 come into play if momentum builds

- Trendline support: That ascending orange line on the charts shows the bigger picture is still intact

What's Next for Traders

Short-term players should brace for volatility. The potential dip to $5.92 isn't a bug - it's a feature of how these patterns typically unfold. Long-term investors might actually welcome a retest since it could offer a better entry point with less downside risk. The bull flag suggests patience could pay off as NIO consolidates before making its next major move toward those higher targets.

Peter Smith

Peter Smith

Peter Smith

Peter Smith