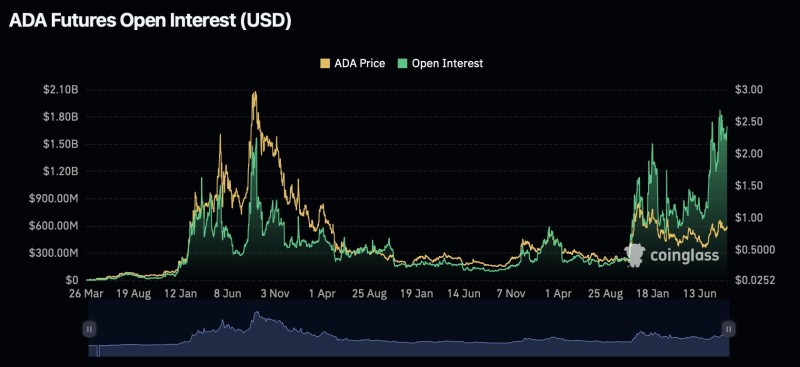

Something big is happening with Cardano. Futures open interest just smashed through $2.5 billion for the first time since 2021's crypto mania. That's not just another number - it's a clear signal that serious money is betting hard on ADA's next move. The leverage game is back, and traders aren't messing around.

ADA Futures Hit Multi-Year Peaks

Data from TapTools shows ADA futures open interest climbing past the $2.5B mark - a level we haven't seen in nearly three years. This puts Cardano among the most heavily leveraged altcoins right now. Open interest tracks the total value of outstanding futures contracts, and when it spikes this hard, volatility usually follows.

The numbers tell an interesting story. Open interest (shown in green) is hitting new highs while ADA's spot price (yellow) sits under $1.00. This gap between speculation and actual price action creates tension. It's the same setup we saw in 2021 when both metrics climbed together during ADA's bull run.

Why Traders Are Going All-In

The leverage surge isn't happening in a vacuum. Several factors are driving this:

- Macro winds shifting: Expectations of easier money policies are boosting crypto risk appetite

- Cardano ecosystem expanding: More DeFi projects and staking activity building confidence

- Altcoin rotation: Traders hunting for bigger gains than Bitcoin can deliver

- Speculation cycle heating up: Classic crypto FOMO starting to kick in

The Double-Edged Sword

Here's the thing about massive leverage - it cuts both ways. If ADA breaks cleanly above $1.00, all that leveraged money could fuel a serious rally. We might see a retest of previous cycle highs. But if the price stalls or drops, those same leveraged positions become liquidation fuel. That means volatility is coming either way.

Cardano's $2.5 billion open interest milestone confirms leverage is officially back in crypto. For anyone watching ADA, this is the setup to pay attention to. The market is loaded with speculative positioning, and the next price move could be explosive - in either direction. The question isn't whether volatility is coming, it's whether bulls or bears will control it.

Peter Smith

Peter Smith

Peter Smith

Peter Smith