- 1) Introduction: Why Banking Software Development Matters in 2025

- 2) Global Market Trends in Banking Software

- 3) Key Criteria for Selecting Top Banking Software Companies

- 4) Itexus — Custom Fintech & Banking Solutions

- 5) Innowise Group — Scalable & Secure Banking Platforms

- 6) SDK.finance — Payments & Core Banking Innovation

- 7) Mambu — SaaS-Based Core Banking Excellence

- 8) Temenos & Thought Machine — Digital Core Leaders

- 9) Finastra, Fiserv & nCino — Global Banking Technology Giants

- 10) How to Choose the Right Banking Software Partner

- 11) Future Trends: AI, Blockchain, Cloud & Open Banking

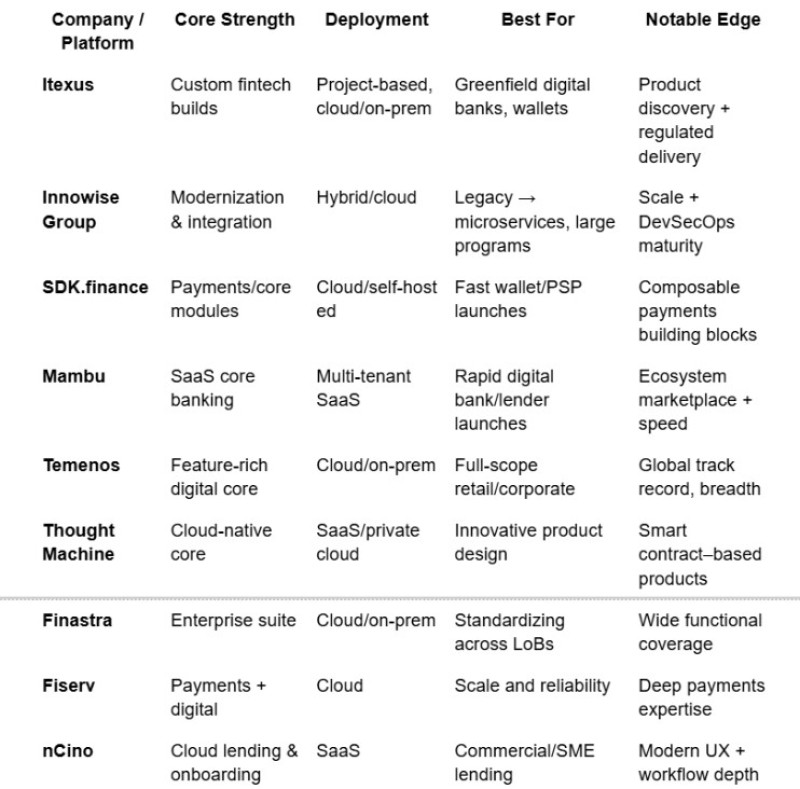

- 12) Comparison Table: When Each Option Fits

- 13) Sample Roadmap: From Idea to Production

- 14) Common Pitfalls (and How to Avoid Them)

- 15) Conclusion: Navigating the Banking Software Landscape

This guide profiles leading Top banking software development companies and platforms—what they do best, when to choose them, and how to evaluate a partner for your roadmap.

1) Introduction: Why Banking Software Development Matters in 2025

Financial services live at the intersection of trust, regulation, and experience. Customers expect:

- Frictionless UX (instant account opening, card issuing, 24/7 support)

- Always-on reliability (zero-downtime core and payments rails)

- Built-in compliance (KYC/AML screening, audit trails, data residency)

- Composable architecture (APIs, microservices, cloud scale)

That mix demands software teams who can translate regulation into elegant product flows, stitch legacy cores to modern services, and ship securely at speed.

2) Global Market Trends in Banking Software

- Cloud-native cores: Banks are moving from monolithic on-prem cores to SaaS/core-as-a-service for faster iteration and lower total cost.

- Open Banking & APIs: Partner ecosystems and banking-as-a-platform are unlocking new revenue.

- Real-time everything: Faster payments, streaming fraud analytics, and instant decisions are the new baseline.

- AI everywhere: From underwriting and collections to service chat, AI copilots now augment ops and compliance.

- Security by design: Zero-trust networks, tokenization, and privacy engineering are table stakes.

<u>Bottom line:</u> Winners combine secure engineering with composable platforms and regulatory literacy.

3) Key Criteria for Selecting Top Banking Software Companies

Product & Architecture

- Cloud-native, microservices, event-driven patterns

- Strong API surface (REST/GraphQL), SDKs, documentation

- Configurability over customization; extensibility via plugins

Security & Compliance

- Evidence of secure SDLC, code reviews, pen-tests

- Regulatory awareness (KYC/AML, PCI DSS, PSD2, FFIEC, data residency)

Delivery & Governance

- Proven banking case studies, references, SLAs

- Transparent roadmaps, versioning, release discipline

- Observability: logs, metrics, tracing, and runbooks

Commercial Fit

- Pricing model aligned to your growth (SaaS vs license)

- Exit strategy (data export), vendor lock-in mitigation

People

- Cross-functional squads (BA + PM + UX + Eng + QA + DevSecOps)

- Domain expertise in your segment (retail, SME, cards, wealth)

4) Itexus — Custom Fintech & Banking Solutions

What they’re known for: End-to-end fintech delivery—discovery to launch—for banks, credit unions, and fintech startups.

Where they shine

- Greenfield builds: Digital banks, neobanking apps, mobile wallets

- Payments & cards: Issuing flows, KYC/KYB onboarding, risk rules

- Data & analytics: Dashboards for operations and compliance

Why pick them

- Blend of business discovery and hands-on engineering

- Flexible engagement (MVP squads → scale-up teams)

- Strong focus on UX + security for regulated apps

Best for: Teams wanting a custom product (not just a boxed core) with a partner experienced in regulated delivery.

5) Innowise Group — Scalable & Secure Banking Platforms

What they’re known for: Large-scale delivery, system integration, and modernization programs.

Where they shine

- Core modernization: Microservices, containerization, CI/CD hardening

- Risk & compliance tooling: Transaction monitoring, auditability

- Enterprise integration: ESB/iPaaS, data pipelines, analytics

Why pick them

- Depth in cloud migration and performance engineering

- Mature QA, DevSecOps, and observability practices

- Comfortable with complex, multi-vendor landscapes

Best for: Banks modernizing legacy stacks without disrupting day-to-day operations.

6) SDK.finance — Payments & Core Banking Innovation

What they’re known for: A modular platform for payments orchestration and digital banking use cases.

Where they shine

- Out-of-the-box modules: Accounts, ledgers, wallets, fees, FX

- Strong API layer for gateways, KYC, and card processors

- Rapid deployment for MVP or regional wallets

Why pick them

- Reduces time-to-market with prebuilt components

- Developer-friendly APIs; configurable workflows

Best for: Fintechs building wallets, PSPs, or multi-rail payments quickly.

7) Mambu — SaaS-Based Core Banking Excellence

What they’re known for: A cloud core used by digital banks and lenders globally.

Where they shine

- Composable core: Deposits, lending, and product factories

- SaaS delivery: Frequent updates, high uptime SLAs

- Partner marketplace: KYC, AML, cards, analytics

Why pick them

- Proven path to launch a digital bank at speed

- Scales from startup to incumbent bank needs

Best for: Institutions favoring SaaS speed and ecosystem breadth over bespoke core customization.

8) Temenos & Thought Machine — Digital Core Leaders

Temenos

- Strengths: Rich functionality (retail, corporate, wealth), global footprint, large partner network

- Why pick: Broad feature coverage, proven regulatory fit across regions

Thought Machine

- Strengths: Cloud-native Vault core with smart contracts for product definition

- Why pick: High flexibility for innovative products (dynamic pricing, interest logic)

Best for: Banks replacing legacy cores with future-proof digital engines.

9) Finastra, Fiserv & nCino — Global Banking Technology Giants

Finastra

- Wide suite: core, payments, lending, treasury, retail/corporate

- Why pick: Enterprise depth; ability to standardize multiple lines of business

Fiserv

- Payments muscle (acquiring, issuing), digital banking platforms

- Why pick: Scale, reliability, and ecosystem connectivity

nCino

- Cloud banking for lending & onboarding (esp. commercial/SME)

- Why pick: Modernize and digitize lending workflows end-to-end

Best for: Institutions seeking battle-tested platforms and global support.

10) How to Choose the Right Banking Software Partner

Match by mission:

- <u>Launch fast?</u> Prefer SaaS/composable cores (e.g., Mambu).

- <u>Modernize legacy?</u> Pick integrators with core-migration chops (e.g., Innowise).

- <u>Own the IP?</u> Choose custom development (e.g., Itexus).

Proof, not promises:

- Ask for banking case studies, demo sandboxes, security attestations.

- Run a time-boxed pilot with real data and success metrics.

Guardrails:

- Data export, incident SLAs, RTO/RPO, and clear version cadence.

- <u>Compliance:</u> KYC/AML integrations, audit trails, and privacy controls from day one.

11) Future Trends: AI, Blockchain, Cloud & Open Banking

- AI copilots: Assisting agents and customers; speeding underwriting, fraud detection, and ops triage.

- Responsible AI: Model governance, explainability, and bias testing will be mandatory.

- Cloud sovereignty: Regional deployments to meet data residency laws.

- Programmable money: Tokenized deposits, wallets, and atomic settlement pilots.

- Embedded finance: Banking capabilities delivered inside non-bank apps.

- Zero-ops reliability: Self-healing platforms, chaos testing, and SRE practices.

<u>Takeaway:</u> Choose partners already shipping in these directions.

12) Comparison Table: When Each Option Fits

13) Sample Roadmap: From Idea to Production

Phase 0 — Strategy (2–4 weeks)

- Business case, use-cases, KPIs, risk register

- Vendor shortlist, sandbox trials

Phase 1 — Pilot (6–12 weeks)

- Limited scope: e.g., e-wallet or SME lending

- Integrations: KYC, payments, core ledger

- Security testing, compliance review

Phase 2 — Scale-up (3–6 months)

- Add products, limits, fees, reporting

- Observability dashboards, runbooks, DR drills

Phase 3 — Optimize (ongoing)

- AI-assisted ops, A/B pricing, churn analytics

- Continuous compliance, threat modeling

14) Common Pitfalls (and How to Avoid Them)

- Customizing too early : Over-fitted builds slow you later. Prefer config-first.

- Ignoring operations: Plan incident response, on-call, and runbooks upfront.

- Vendor lock-in: Ensure data export and clear reversibility paths.

- Security last: Shift-left security (code scans, secrets mgmt, least privilege).

- Compliance as a blocker: Bake in auditability and policy-as-code early.

In 2025, choosing a banking software partner is less about a single “best” product and more about fit: your use-case, speed, risk appetite, and operating model.

- Want speed to market? Choose Mambu or SDK.finance for composable acceleration.

- Need deep modernization? Look to Innowise Group for integration and scale.

- Prefer custom IP with a regulated-ready team? Itexus is a strong build-partner.

- Replacing a legacy core? Temenos or Thought Machine lead the digital-core wave.

- Seeking enterprise breadth? Finastra, Fiserv, and nCino deliver proven domain depth.

Final advice: Start small with a pilot, measure relentlessly, and scale what works. In banking, trust is earned in production—with resilient code, clean integrations, and experiences customers love.

Quick Checklist (Copy-Paste for your RFP)

- Architecture: Cloud-native, microservices, APIs, eventing

- Security: Secure SDLC, pen-tests, secrets mgmt, zero-trust

- Compliance: KYC/AML, audit logs, data residency, PCI/PSD2 where relevant

- Ops: SLAs, SRE, observability, DR (RTO/RPO)

- Data: Export, lineage, masking, retention policies

- Ecosystem: Connectors for KYC, payments, cards, analytics

- Commercials: Transparent pricing, exit plan, roadmap access

Build the bank your customers deserve—one reliable, compliant, delightful service at a time.

Editorial staff

Editorial staff

Editorial staff

Editorial staff