Every August, central bankers from around the world gather in the scenic mountains of Jackson Hole, Wyoming, for what has become the most closely watched monetary policy event of the year. What started as a quiet academic symposium has evolved into a market-moving spectacle where a single phrase can send currencies soaring or crashing.

This year's gathering carries exceptional weight. With global markets on edge and the US economy at a crossroads, Federal Reserve Chair Jerome Powell's keynote address isn't just another policy speech—it's a moment that could define the dollar's direction for months to come. Traders are positioning themselves for what could be one of the most consequential Jackson Hole speeches in recent memory.

The Stakes Have Never Been Higher

Jerome Powell steps up to the podium at Jackson Hole knowing every word will be dissected by traders worldwide. It's not just another Fed speech—it's a defining moment that could reshape how markets view both his leadership and the dollar's trajectory.

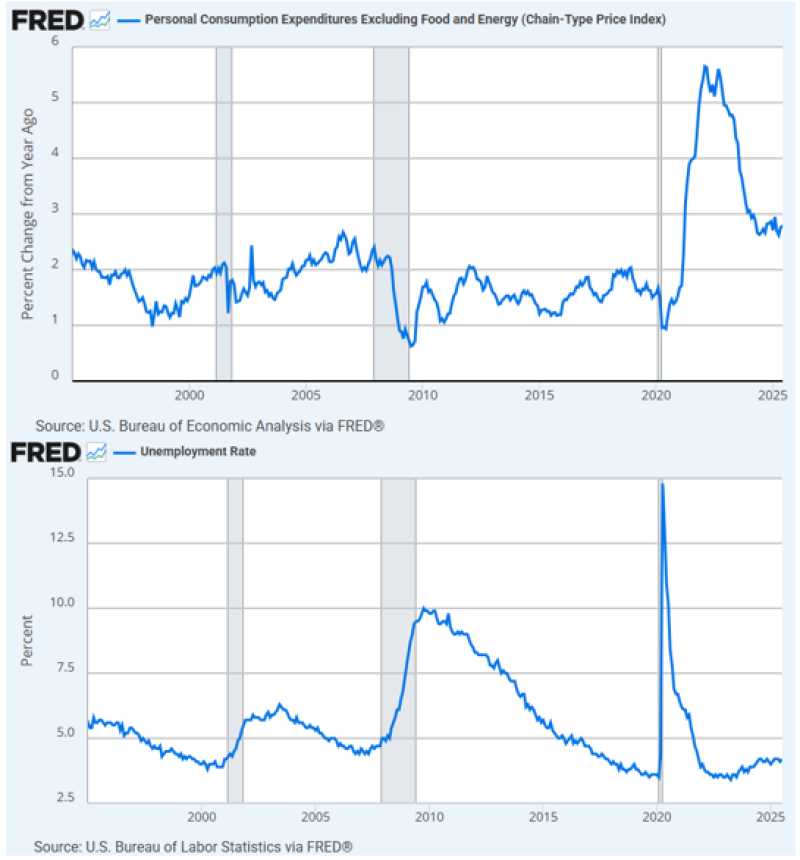

Right now, the Fed finds itself in a tricky spot. Core inflation is stuck around 3%, refusing to budge toward the 2% target despite aggressive rate hikes. Meanwhile, unemployment sits comfortably at 4%, suggesting the job market isn't cracking under pressure. This combination puts Powell in a bind: push too hard and risk breaking something, ease up and let inflation run hot.

Why This Speech Matters for the Dollar

The dollar's recent performance hinges on one question: how long will the Fed keep rates elevated? If Powell doubles down on his inflation-fighting credentials, expect the greenback to surge as investors chase higher yields. But any hint that he's worried about economic cracks could send the dollar tumbling.

Here's what makes this different from previous Jackson Hole speeches: Powell isn't just managing monetary policy—he's defending the Fed's credibility in an election year. Political pressure is mounting, and markets are watching to see if he'll blink.

The Inflation Puzzle That Won't Go Away

Twenty years ago, keeping inflation near 2% seemed almost automatic. Then the pandemic hit, and everything changed. Despite the Fed's most aggressive tightening cycle in decades, core PCE inflation has plateaued around 3%—progress, sure, but not victory.

For dollar bulls, this stubborn inflation is actually good news. It means the Fed can't declare mission accomplished and start cutting rates aggressively. But bears point to signs that the economy might be cooling, arguing that Powell needs to pivot before it's too late.

What to Watch For

Powell's tone will matter as much as his words. A confident, hawkish Powell talking about the need for patience could send the dollar soaring. But if he sounds cautious or mentions "data dependency" too many times, traders might start betting on rate cuts sooner than expected.

The labor market will be key. At 4% unemployment, there's still room for the Fed to stay tough. But if Powell acknowledges any softening in job growth, it could signal the beginning of the end for this tightening cycle.

Peter Smith

Peter Smith

Peter Smith

Peter Smith