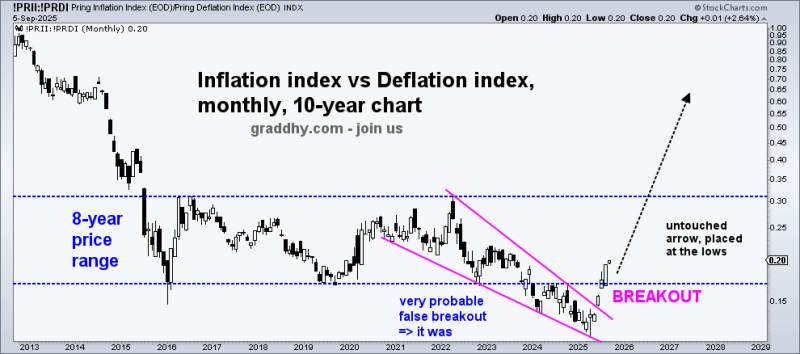

A technical breakout from an 8-year consolidation pattern suggests inflationary pressures may be returning, potentially signaling the start of another inflation cycle.

Clear Signal After Years of Sideways Movement

The inflation vs deflation index has broken out of an 8-year range and a bullish falling wedge pattern, signaling potential return of inflationary forces. After a false breakdown in 2024, the index now trades above 0.20, targeting the 0.35–0.40 zone. Analyst warns investors should prepare for stronger inflationary pressures ahead.

Technical Picture Shows Bullish Setup

The 10-year chart reveals the index's struggle between inflation and deflation from 2016-2024, confined between 0.15 support and 0.35 resistance. A falling wedge pattern compressed price action from 2022-2025 before the recent breakout above the former range, pointing toward potential acceleration to levels associated with past inflationary strength.

Multiple Factors Support Rising Inflation

Several forces appear to be driving this breakout: anticipated rate cuts could reignite demand-driven inflation, energy prices are trending higher, persistent government spending adds fuel to inflationary pressure, and ongoing supply chain restructuring continues raising costs across critical industries.

If the breakout holds, the index could rally toward 0.35–0.40, confirming a new inflation wave while pressuring bonds and boosting commodities. However, failure to sustain above 0.20 would imply deflationary forces still dominate and inflation fears remain overstated.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah