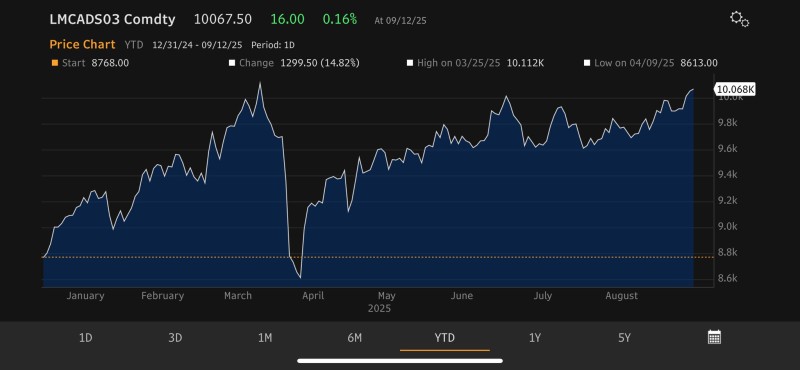

Copper is flashing warning signs again. The industrial metal just climbed back to its yearly highs, with benchmark prices hitting 10,067.50 - a solid 14.8% gain since January. That puts us right back where we were in March, and traders are starting to wonder if this is the beginning of something bigger. When copper moves like this, it usually means something important is happening in the real economy.

What's Driving the Rally

The chart tells a clear story of recovery. After hitting brutal lows of 8,613 in April, copper has been grinding higher all summer. Breaking back above the psychological 10,000 level confirms this isn't just a dead cat bounce - there's real demand behind this move. As Spencer Hakimian pointed out, this could be early warning of commodity inflation creeping back into the system.

The fundamentals behind this surge are pretty straightforward:

- Chinese factories are ramping up production as infrastructure spending kicks into high gear

- Supply remains tight thanks to ongoing mine disruptions and labor strikes in key producing countries

- The green energy transition keeps boosting long-term demand for EVs, batteries, and grid infrastructure

This mix of immediate demand and structural shifts has turned copper into both a growth play and an inflation hedge. When you see moves like this, it usually means the global economy is heating up faster than expected.

The Inflation Question

Here's why this matters beyond just copper traders. The metal earned its nickname "Doctor of the Economy" because it has an uncanny ability to predict broader economic trends before they show up in official data. A sustained rally at these levels typically translates into higher costs for manufacturers, which eventually trickles down to consumer prices.

If copper holds above 10,000, the next target becomes the March high of 10,112. Break that, and we could be looking at fresh multi-year highs. But if prices fall back below 9,600, it might just be another false breakout before the real move higher.

Right now, the bulls are clearly in charge. This is shaping up to be copper's strongest year since 2021, and whether it signals the start of an industrial supercycle or just warns of commodity inflation ahead, one thing's certain - global markets can't afford to ignore what copper is telling us.

Peter Smith

Peter Smith

Peter Smith

Peter Smith